The municipal bond market has recently experienced a shift that reignites interest among investors and analysts alike. After a string of consecutive sessions characterized by rising yields, we observed notable gains in the sector, leading to a decline in municipal yields of up to seven basis points. In tandem, U.S. Treasuries exhibited slight improvements, while equities delivered mixed results. This article aims to dissect these developments, focusing on the implications for both municipal markets and broader economic indicators.

The drop in municipal yields, as evidenced by Refinitiv Municipal Market Data and ICE Data Services, illustrates a momentary respite for bondholders and investors. The recent ratios for municipal-to-Treasury yields showed slight declines. Specifically, the two-year ratio stood at 66%, and the 30-year at 87%, highlighting heightened attractiveness for municipal bonds against their Treasury counterparts. This trend may reflect a recalibration of investor expectations, particularly in light of recent interest rate movements from the Federal Reserve.

Yield dynamics are critical during this period, especially given the Federal Reserve’s earlier indications of potential rate cuts. Investors looking at shorter maturities, such as the two-year and three-year bonds, are particularly sensitive to these shifts, as they bear the brunt of any compression in returns due to rising rates.

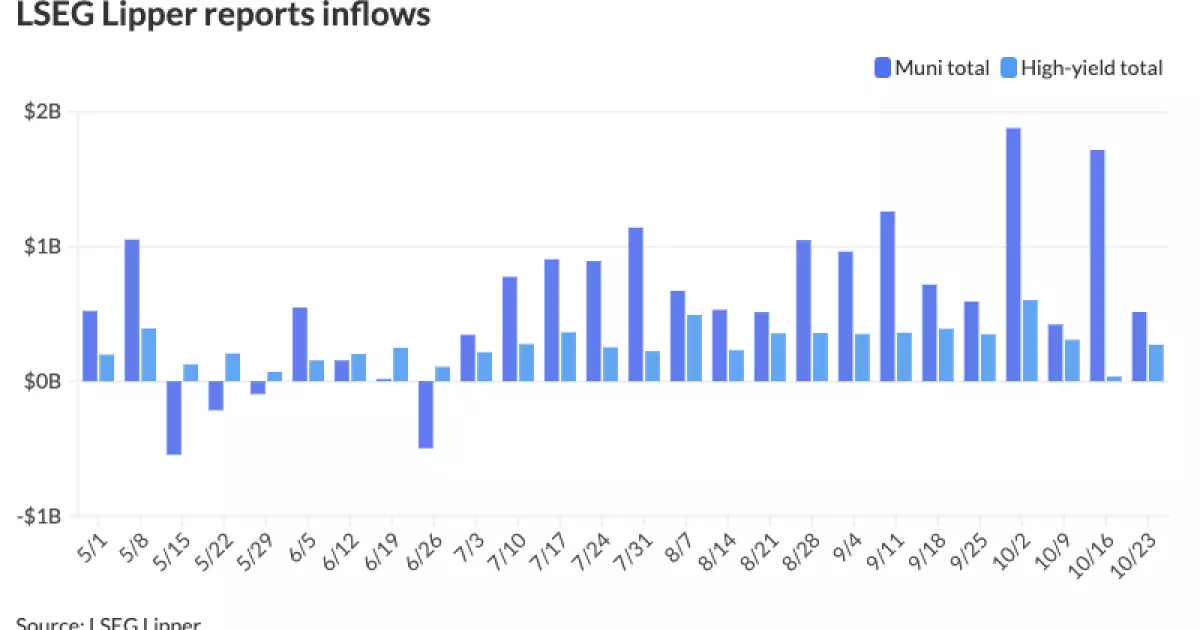

Inflows into municipal bond mutual funds continue to demonstrate resilient investor interest, amounting to $514.7 million in the most recent week, albeit a decrease from the preceding week’s inflow of $1.718 billion. This marks the 17th consecutive week of positive inflows, with a significant portion attributed to high-yield funds, which experienced inflows of $271.8 million. Analysts note that these inflows are largely correlated with the performance of bond markets from June through September, during which returns were favorable.

However, a recent downturn in returns during October, seeing an overall loss of 1.88%, signifies a challenging landscape for municipal investments as year-to-date returns also plummeted to 0.37%. Sheila May from GW&K Investment Management attributes this fluctuation to contrasting economic data emerging in recent prints, including robust employment reports and consumer spending.

Investors are navigating a complex environment, weighing immediate market shifts against a backdrop of historical performance. The rising interest rates and their subsequent influence on municipal bond attractiveness cannot be understated as investors look for stable investment avenues amidst economic uncertainty.

Despite the recent turbulence, fundamental factors in the municipal market remain solid. The current credit upgrade-to-downgrade ratio stands at a promising 3.5:1 in favor of upgrades. The annual issuance of bonds has surged, reaching $418.451 billion—a remarkable 41.1% year-over-year increase. This upturn is primarily fueled by a combination of controlled inflation and a ramp-up in state and local government financing needs.

Nonetheless, market commentators alert investors to consider technical factors which have become “less supportive.” The surge in issuance reflects ongoing infrastructural needs and government initiatives to tackle pressing maintenance delays across sectors like education and public utilities, highlighting a backlog of deferred maintenance that amounts to trillions.

The increasing issuance of new bonds could either present an opportunity or a challenge for investors as they assess future cash flow and potential yields against still-evolving economic conditions.

Looking forward, many experts predict continued strength in the municipal market, with several large deals anticipated in the coming weeks. Timlin from Sage Advisory notes that we may witness record levels of issuance in 2024, particularly preemptively as issuers look to take advantage of market conditions before holiday seasons slow trading activity.

However, this surge in supply could lead to further “cheapening” within the market, influenced by a combination of election-related uncertainties and shifting dynamics. The active nature of the municipal bond market remains a point of focus as analysts forecast how political developments and economic indicators will guide future trends.

As we close this exploration of the current state of municipal bonds, it is essential for investors to remain vigilant and adaptable. Understanding the intricate balance of yields, inflows, and economic fundamentals will be crucial in navigating the complexities of this evolving landscape.

Leave a Reply