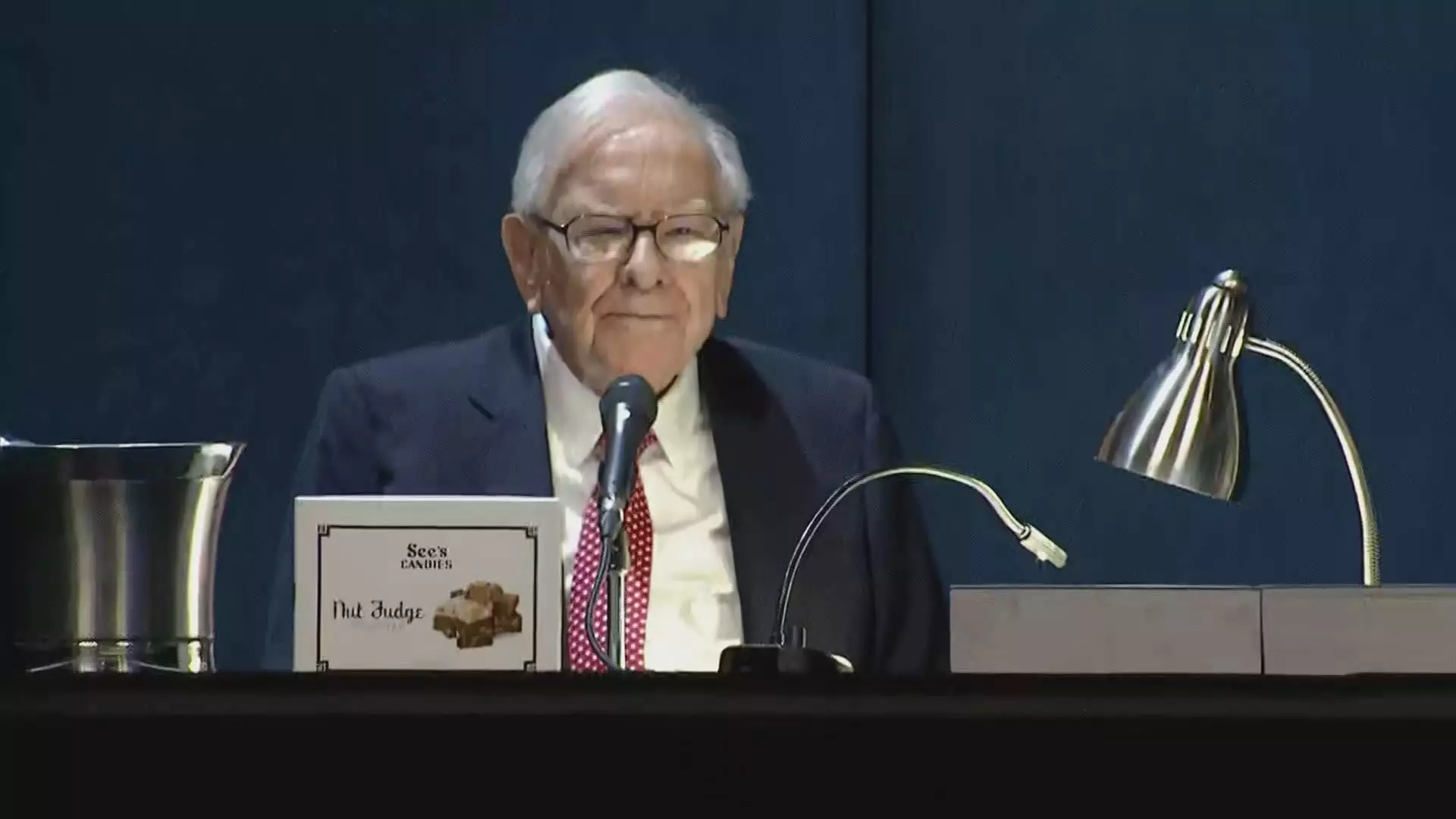

Warren Buffett has made headlines yet again, this time for significantly reducing Berkshire Hathaway’s stake in Apple. This sell-off marks the fourth consecutive quarter in which the Omaha-based conglomerate has downsized its largest equity holding. As of the end of September, Berkshire’s investment in Apple was valued at approximately $69.9 billion, reflecting a substantial offloading of shares — roughly 300 million remain. This represents a staggering 67.2% decrease from the previous year’s third-quarter figures. A detailed look into this selling pattern reveals underlying motivations, market conditions, and the broader implications for both Buffett and Berkshire Hathaway.

Buffett’s divestment began in earnest during the fourth quarter of 2023, with a dramatic acceleration of sales noted in the second quarter. The decision to significantly trim the apple stake raises questions about the influencer behind such movements. Market analysts have speculated that a combination of factors, including high stock valuations and a desire to rebalance the equity portfolio, played crucial roles in this decision. At its peak, Berkshire’s Apple shares constituted half of its entire equity portfolio, prompting concerns over potential concentration risks.

Furthermore, during May’s annual meeting, Buffett hinted at a strategic rationale tied to tax considerations, suggesting that the possibility of increased capital gains taxes loomed on the horizon. This financial foresight aligns well with Buffett’s historical reputation for calculated investing. Nonetheless, as the sell-off intensified, many analysts posited that the rationale for shedding Apple shares might extend beyond mere tax strategy.

Notably, Buffett’s initial foray into technology, particularly Apple, was a significant pivot for an investor primarily known for traditionally avoiding tech stocks. Berkshire began purchasing Apple shares in 2016, under the guidance of investment managers Ted Weschler and Todd Combs. Buffett was drawn to Apple’s robust customer loyalty and the broad appeal of the iPhone. He ultimately elevated Apple to the very forefront of his investment portfolio, even dubbing it the second-most critical business after his insurance conglomerates. This evolution illustrates Buffett’s adaptability and willingness to embrace emerging sectors when opportunities arise.

While Apple shares have shown resilience, climbing 16% this year, this performance is overshadowed by the broader market, with the S&P 500 increasing by 20%. Prompted by the ongoing sell-off, Berkshire has amassed an unprecedented cash position of $325.2 billion — an all-time high. The company’s pause on share buybacks during the third quarter underscores a strategic shift, possibly signaling a more cautious approach to capital deployment amidst evolving market dynamics.

Warren Buffett’s recent actions regarding Apple shares provide a fascinating case study of strategic investment management. As the story of Berkshire Hathaway unfolds, investors and analysts must consider not only the immediate financial implications but also the potential long-term vision that may guide Buffett’s decisions, especially in an ever-changing economic landscape.

Leave a Reply