The municipal bond market is currently experiencing a phase of cautious optimism, highlighted by the distinctive decoupling of municipal bonds from their U.S. Treasury counterparts. Despite the backdrop of recent losses in the Treasury market, municipal securities demonstrated resilient dynamics as they navigated through a complex financial landscape. This article delves into the intricate interplays between municipal bonds and U.S. Treasuries, investor sentiment, and prospective market deals that shape this segment.

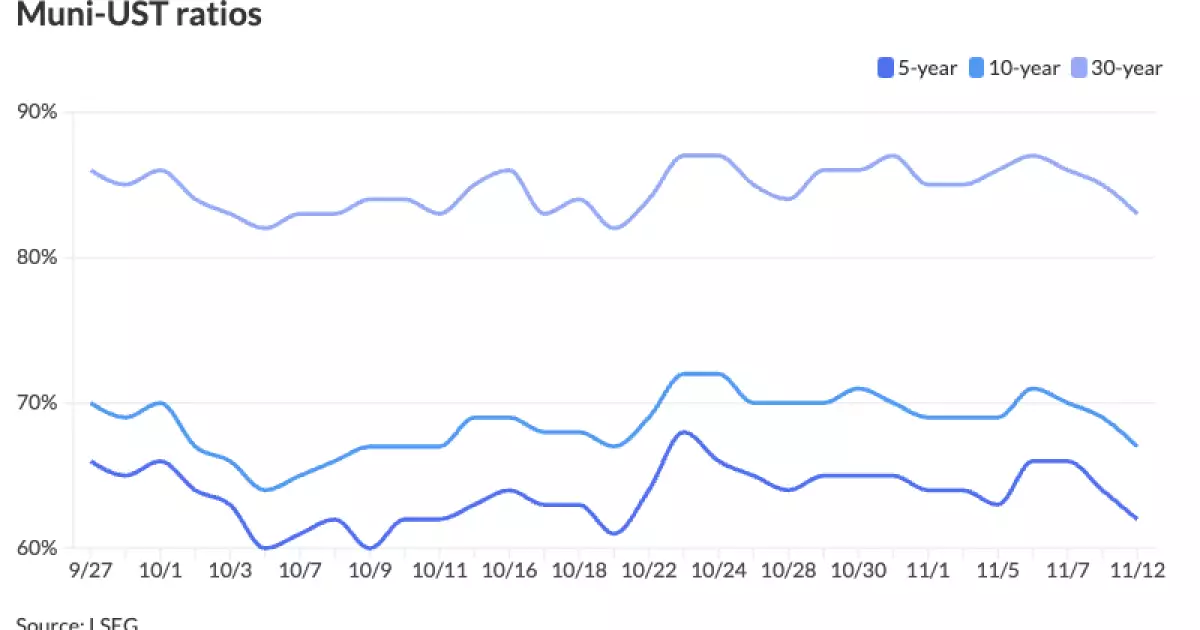

On a day marked by losses in the U.S. Treasury market—where the 10-year note felt the brunt of declines nearing 12 basis points—the municipal bond market exhibited mixed yet notable behaviors. The shifts in Triple-A yield curves indicated minor adjustments, with some maturities experiencing yield bumps while others saw reductions. As of the latest readings from Refinitiv Municipal Market Data, the ratios comparing municipal bonds to U.S. Treasuries illustrated that demand for munis remains healthy, with the two-year ratio at 61% and the 30-year at 83%. This performance signifies that municipal bonds are temporarily outperforming their Treasury peers, with remarkable gains year-to-date reflecting stronger relative value.

The fundamental divergence between the two markets suggests a growing investor preference for the perceived safety of municipal bonds amid macroeconomic uncertainties. Diminishing yields in municipal bonds stem from a combination of factors, including structural market changes, investor sentiment, and external economic indicators. The prevailing interest appears directed towards the comfort municipalities can provide, with investors seeking stable long-term returns, even as the overall Treasury environment experiences volatility.

Investor behavior in the municipal bond sector reveals an intriguing narrative of demand resilience amidst fluctuating market conditions. According to Sudip Mukherjee of UBS, last week’s trading environment reflected a subtle adjustment wherein earlier volatility prompted a welcoming environment for municipal investments. The influence of reinvestment demand from principal and interest payouts created further momentum, highlighted by a significant $14.3 billion principal payout combined with $7 billion in interest on November 1.

Supporting that stance, analysts have noticed a trend of accelerating inflows into municipal mutual funds—amounting to a remarkable $1.263 billion last week—indicating a sustained investor appetite for municipal securities. However, caution is warranted as Luby from CreditSights anticipates a potential slowing down of net new-money flows, typically witnessed at the close of the calendar year. Such seasonal patterns in investor behavior do not inherently compromise demand but reflect a more strategic approach as advisors and investors navigate potential tax liabilities from capital gains distributions.

Upcoming Municipal Deals: Market Readiness

Looking ahead, the municipal bond market is gearing up for a series of significant upcoming deals—a vital indicator of market liquidity and sustained investor interest. Major issuances are on the horizon, with Houston set to price $1 billion of revenue bonds for a United Airlines project, alongside other substantial offerings from Maricopa County and the Greater Aviation Authority.

These upcoming transactions are likely to affect overall market dynamics and could contribute to a shifting supply-demand balance. Importantly, the future supply in the market may encounter hurdles considering the limited number of trading weeks remaining in December, which poses risks for potential reinvestment opportunities. Nevertheless, the scheduled sizeable offerings are expected to maintain investor focus on the municipal market as they seek attractive yields amidst existing competition from Treasuries.

The current environment for municipal bonds showcases an intricate balance between navigating market volatility and sustaining investor demand. The subtle divergences in performance relative to U.S. Treasuries underscore a critical juncture for the municipal market, emphasizing its role as a safer investment alternative in turbulent times. With substantial deals lined up and favorable ratios supporting continued interest, the outlook remains that the municipal market could emerge not only resilient but increasingly attractive as 2024 unfolds.

Investors should remain vigilant yet optimistic about the evolving financial tapestry and its implications on municipal bond strategies, ensuring they effectively grasp the nuances of a market poised for growth amidst complexities.

Leave a Reply