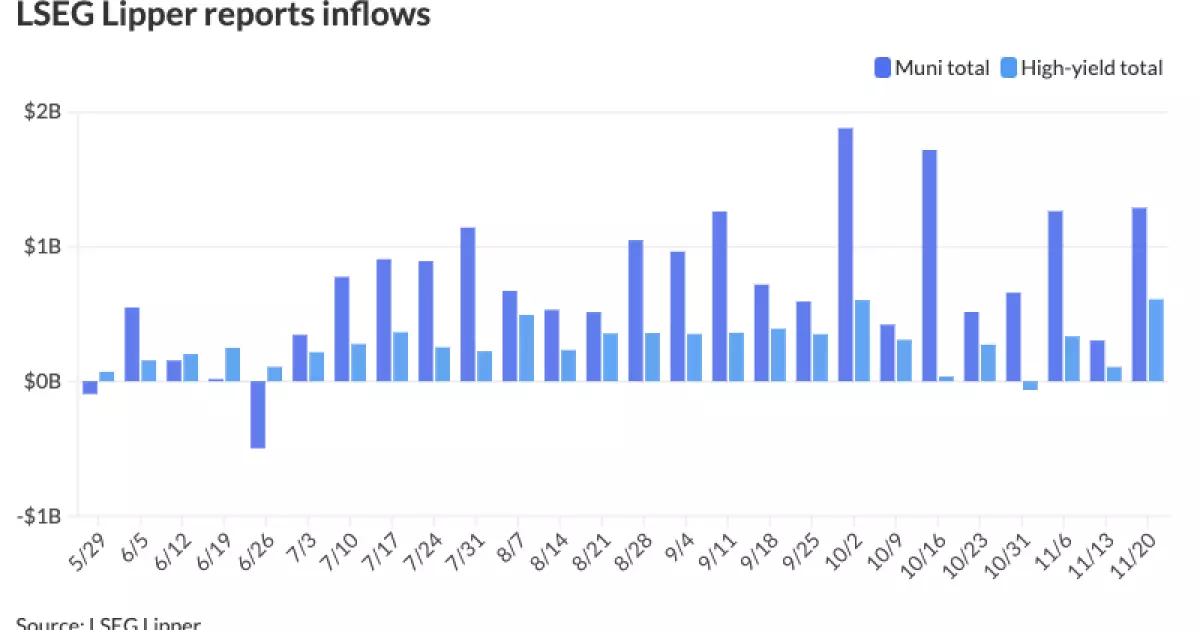

The municipal bond market, often seen as a bastion of stability during turbulent economic periods, displayed remarkable resilience in its latest performance. In a recent report, municipal bonds experienced little change despite significant inflows into municipal mutual funds, which amounted to over $1 billion. This inflow reflects the ongoing investor confidence in the municipal bond sector, confirmed by LSEG Lipper’s reporting of a cumulative $1.288 billion inflow for the week ending Wednesday. The last week showed a stark contrast with only $303.2 million in inflows. This trend of sustained investment marks the 21st consecutive week of net inflows, emphasizing a robust appetite for municipal securities.

High-yield municipal funds, in particular, witnessed a significant surge, attracting $608.9 million in inflows compared to the previous week’s $150.3 million. This can be attributed to changing investor preferences and the search for yield in a low-interest-rate environment. However, while yields on the highest-rated municipal bonds remained stable, U.S. Treasury (UST) yields demonstrated a mixed performance, rising in short-term benchmarks while declining further out in the curve.

Market Dynamics and the Impact of Treasury Yields

A key focus among investors is the relationship between municipal bond yields and their Treasury counterparts. The current municipal-to-UST yield ratios highlight an interesting dynamic: for instance, the two-year ratio at 60% and the thirty-year at 82% suggest that municipal bonds are becoming increasingly attractive relative to Treasuries. This has implications for those concerned about tax liabilities, as municipal bonds often offer a tax-exempt status that enhances their appeal.

Brad Libby, a fixed-income portfolio manager and analyst, noted a notably receptive primary market this week, with large bond offerings being executed smoothly. Investment vehicles with an A or AA rating saw overwhelming demand, often being oversubscribed by five to ten times, leading to slight upward adjustments in yields. This signals a positive sentiment towards credit quality, even as the broader market grapples with economic uncertainties.

Adding to this landscape, a flock of new municipal issuances, including funding for various projects across states, has fed the insatiable demand while also maintaining fundamental market integrity.

The flow of new issuances in the municipal space is set to slow down significantly in light of the upcoming Thanksgiving holiday. According to market analysts, visible supply metrics recorded in the Bond Buyer indicate a falling supply, with only $5.58 billion currently available. Predictions for the remainder of the year suggest an influx of approximately $25 billion to $35 billion in new issues, predominantly expected shortly after Thanksgiving.

However, this influx may not guarantee stable pricing; as Libby points out, investor behavior around reinvestment and fund flows could impact the market landscape significantly. The first part of December may see robust reinvestment dollars entering the market, introduced further by the traditional year-end investment rush.

Moreover, external factors such as U.S. Treasury yield changes and inflationary sentiments could play pivotal roles in shaping the sentiment in the municipal market. Recent elections and forthcoming Federal Reserve meetings, highlighting likely rate adjustments, are also set to create ripples. Libby mentions an 80% prediction of a 25-basis-point rate cut, with further cuts likely in the upcoming year.

The current environment has ignited discussions around the relative attractiveness of municipal bonds, especially for individuals in higher tax brackets. The durable balance of risk and rewards associated with these securities continues to inspire investor confidence, even in face of potential inflation pressures.

Cooper Howard, a strategist at Charles Schwab, articulated that despite bumps in UST yields, the municipal sector has been resilient. The robust yield curve for municipalities, while tighter, indicates a unique positioning offering compelling opportunities, especially for wealthier investors who can utilize the tax-exempt status effectively.

Looking towards future market trajectories, attention will be keenly placed on new legislative and economic measures that could steer the fiscal landscape. The potential impacts of tariffs, immigration policies, and other governmental activities will be scrutinized closely, as they may send tremors through the already volatile market structures.

Ultimately, as municipal bonds face the tests of time within turbulent economic conditions, their consistent performance and investor interest may continue paving the path for a steady sector, albeit with caution warranted as we approach significant fiscal events ahead.

Leave a Reply