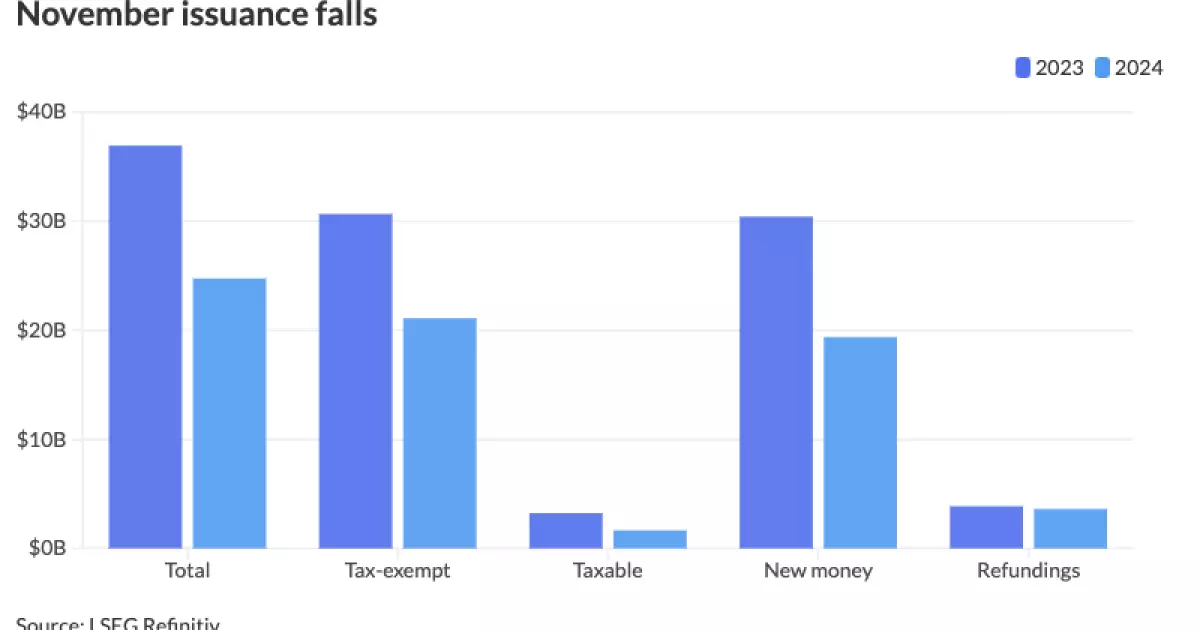

In November 2024, municipal bond issuance experienced a marked decline compared to the same month in 2023, representing the first year-over-year decrease in supply within the year. The total issuance for November hovered around $24.743 billion spread over 607 separate bond issues, demonstrating a staggering 33% decrease from the previous year’s figures of $36.918 billion across 822 issues. This downturn is even more noteworthy as it fell short of the 10-year average monthly issuance of $32.278 billion, rendering it the lowest monthly issuance for the year so far. However, despite this dip, 2024 is poised to surpass historic issuance figures, potentially exceeding the previous record set in 2020.

Although November starkly contrasts with previous months, the overall year-to-date issuance stands impressively at $474.755 billion, reflecting an increase of 32.8% year-over-year. This cumulative figure highlights the resilience of the market throughout the year, despite November’s declines. As December approaches—a month that has historically averaged $32.452 billion in issuance over the last decade—the trajectory suggests that the total for 2024 could reach around $500 billion or more by year’s end. This anticipated outcome encourages optimism for market participants, although factors influencing future decisions remain complicated.

Contributing Factors: Market Dynamics and External Events

Several underlying factors contributed to the significant drop in November issuance. Notably, the scarcity of available pricing days hindered the ability of issuers to enter the market effectively. According to Tom Kozlik, the head of public policy and municipal strategy for HilltopSecurities, these calendar limitations played a critical role. The first week of November was overshadowed by both election preparations and the Federal Open Market Committee meeting, whereas the final week was hindered by the Thanksgiving holiday. This cluster of events resulted in minimal issuance activities during crucial periods that typically promote more robust market participation.

Chad Farrington, co-head of municipal bond investment strategy at DWS, added that the interplay of these complex factors created a uniquely challenging environment for issuers during November, with many deals spaced apart rather than clustered together as seen in previous months.

Election-related volatility added an additional layer of complexity to the mixed scenario for November. Although early predictions indicated heightened market fluctuation in the lead-up to the elections, the eventual impact proved more muted than anticipated. Following the elections, yields experienced fluctuations but stabilized thereafter, leading to less pronounced volatility in the weeks that followed.

Significantly, ongoing concerns about the future of tax-exempt municipal bonds loom large on the horizon. Analysts differ sharply on potential tax reforms and their consequences for the market, leading to varying forecasts for issuance in 2025. Kozlik envisions a landscape wherein potential changes curtail or eliminate the current muni bond tax exemptions, prompting issuers to flood the market in 2025 to capitalize on favorable conditions before any changes could take effect.

However, Matt Fabian from Municipal Market Analytics presented a contrasting outlook, anticipating that substantial cuts to the tax exemption could drastically reduce issuance to anywhere from $250 billion to $300 billion—far lower than the prevailing industry consensus.

Diving deeper into regional analyses, states such as California, Texas, and New York demonstrated robust participation in bond issuance year-to-date. California, leading with a staggering $68.902 billion, saw a 31.1% growth compared to 2023. Similarly, Texas and New York followed suit, showcasing strong performances with increases of 16.3% and 37.8%, respectively.

Interestingly, Florida’s issuance soared by an impressive 103.8%, highlighting the diverse trajectories states may take in navigating bond issuances amid fluctuating national and economic conditions. Other states, such as Pennsylvania and Illinois, also reported significant increases, reinforcing the notion that strong regional participation can vary widely, driven by local economic conditions and needs.

The situation in the municipal bond market as of November exemplifies a complex dance of uncertainty, opportunity, and fluctuating demand. While November’s numbers signal a year-over-year decline, the broader trends suggest robust growth potential moving into 2025, despite the specter of potential tax reforms. As market participants grapple with these dynamics, vigilance will be essential in navigating the shifting landscape of municipal finance. The anticipation of record-breaking issuance levels juxtaposed with growing concerns reveals an intrinsic tension that will shape the forthcoming months, marking a critical period for issuers and investors alike.

Leave a Reply