The municipal bond market has exhibited significant growth during the third quarter of 2024, a trend driven by various factors, including a surge in supply coupled with heightened participation from institutional players. According to recent Federal Reserve data, key entities such as mutual funds, exchange-traded funds (ETFs), and foreign investors raised their stakes in this asset class. Despite these positive indicators, a stark reality remains: institutional holdings, particularly those led by banks, continue to decline, a situation analysts do not foresee changing in the near future. For instance, Barclays strategists have pointed out in their weekly report that bank ownership of municipal bonds has dipped to $497.2 billion, reflecting a minor decrease from the previous quarter and a more significant decline year-over-year.

The drop in bank ownership is largely attributed to the repercussions of prior regulatory pressures and deposit outflows, especially within smaller and medium-sized regional banks. As these banks grapple with diminished deposits, their appetite for municipal assets, including high-quality, long-duration bonds, has waned considerably. This phenomenon creates a ripple effect across the market as reduced demand hampers overall liquidity and pricing strategies.

The obstacles concerning institutional ownership are compounded by several regulatory challenges faced by banks in recent years. As outlined by Wells Fargo strategists in their 2025 outlook, smaller banks have encountered severe hurdles, impacting their balance sheets and, indirectly, their asset acquisition strategies. Larger banks, which ideally would be capitalizing on newfound deposit bases post-turmoil, have not seen corresponding increases in their balance sheets due to heightened scrutiny of their financial health and operational strategies.

While there is hope that deregulation may alleviate some constraints, enabling banks to expand their balance sheets and thus increase demand for municipal bonds, the current landscape remains hesitant. Despite the potential for increased liquidity and access to capital, institutional investors must navigate a complex terrain characterized by inconsistent deposit inflows and lingering regulatory burdens.

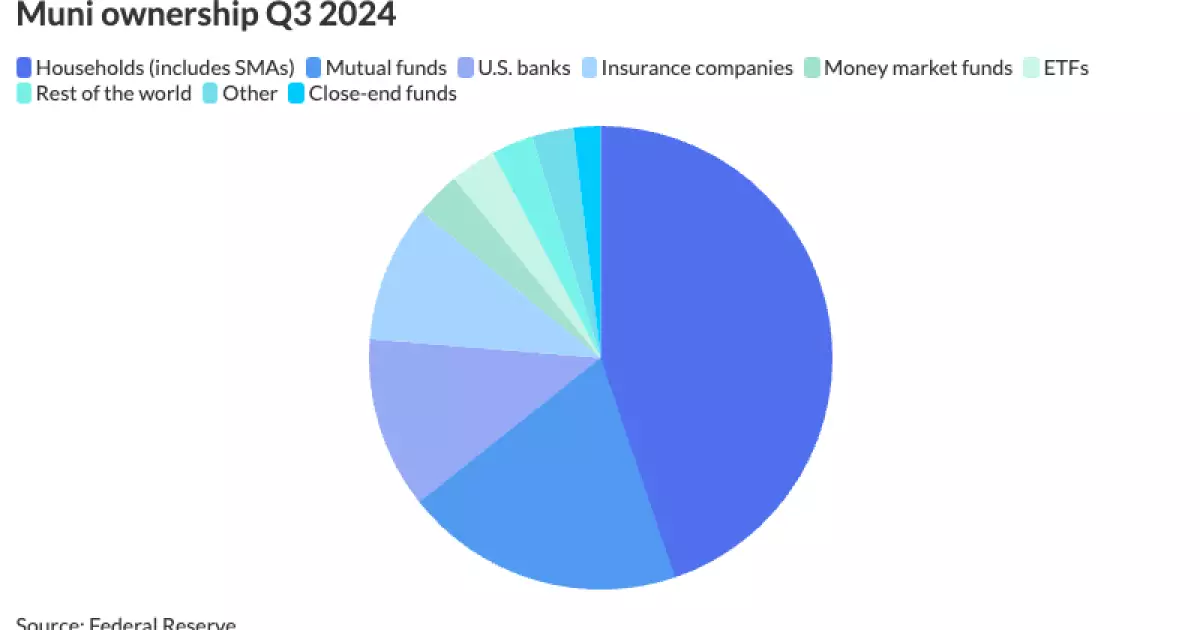

Interestingly, the structure of municipal bond ownership has evolved, with household investments in individual bonds emerging as the dominant category—accounting for a substantial 44.8%. Mutual funds represent another significant player at 19.5%, while ETFs and U.S. banks account for 3.2% and 12%, respectively. Moreover, the growth in foreign ownership of municipal bonds, which stands at $121.5 billion, underscores increasing global interest in U.S. municipal debt as a stable investment vehicle.

Household ownership of munis has surged remarkably to $1.86 trillion, fuelled by the growth of separately managed accounts (SMAs). These accounts have become a favored vehicle for investors, allowing them to maintain personalized investment strategies while also benefiting from the inherent safety and income potential of municipal bonds. Through SMAs, households have collectively bolstered their positions, taking advantage of the favorable tax treatment and yield benefits municipal bonds offer.

A crucial insight from recent market activity indicates that 2024 has witnessed a notable uptick in fund flows directed toward municipal ETFs and open-end mutual funds alike. The data reveals that mutual funds amassed $810.9 billion, a rise of 4% from the previous quarter and 11.4% from Q3 2023. Alternatively, ETFs surged to $133.3 billion—marking a remarkable 23.4% increase year-over-year. This growth in the ETF sector suggests a thematic shift in investor preferences, with a notable emphasis on lower transaction costs associated with ETFs compared to traditional cash bonds.

Moreover, the landscape is also witnessing a significant transition from active to passive investment strategies. As investors grow more comfortable with passive management in the absence of credit stress, the appeal of municipal ETFs has intensified. Strategists from Wells Fargo posit that the efficiencies offered by ETFs, particularly in trading costs and transparency, have drawn considerable attention, pushing investors away from actively managed funds that may not consistently outperform their passive counterparts.

Despite the commendable growth in various sectors of the municipal bond market, experts caution against overestimating the potential for rapid expansion. The stark absence of tax-loss harvesting opportunities and the pressures from competing equity markets indicate that the meteoric rise experienced in 2022-2023 may not replicate in the near term. As the market navigates through these complexities, it remains critical for investors to stay informed about regulatory dynamics and market trends that could influence their investment strategies.

The municipal bond market continues to evolve through a combination of growth, challenges, and shifts in investor preferences, setting the stage for future trends that could redefine the landscape of municipal investments.

Leave a Reply