The municipal bond market has been experiencing a fascinating confluence of factors that are shaping investor sentiment and market dynamics. As municipal yields have shown slight fluctuations amidst a backdrop of stronger U.S. Treasury returns, there is concern and optimism converging within the market as we approach the year-end of 2024. This article delves into the key trends impacting the municipal bond landscape and makes projections for 2025.

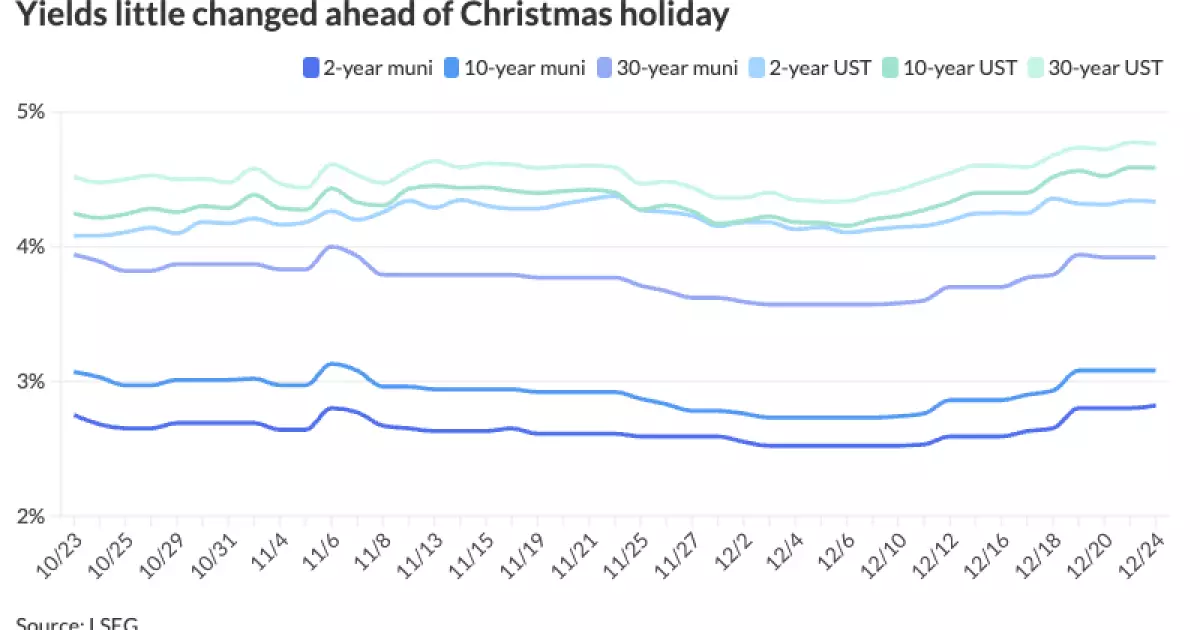

On a recent Tuesday, the municipal bond market exhibited a combination of stability and slight softening. Yields on triple-A rated securities increased marginally while standing in contrast to the performance of U.S. Treasuries, which ended the session on a stronger note. This dichotomy in yield behavior, with U.S. Treasuries experiencing a slight dip in yields of one or two basis points, underlines a nuanced trading atmosphere, where municipal bonds seem to find a stable demand despite the broader pressures.

The yield ratios between municipal and U.S. Treasuries demonstrate a level of consistency, particularly in shorter maturities, revealing a robust demand for tax-exempt securities. For example, the two-year and five-year ratios stood at 65%, a figure that reflects investor confidence in the stability of municipal bonds. Interestingly, the longer 30-year amortization saw a ratio of 82%, indicating an appetite among investors for long-term, tax-exempt instruments.

As the final days of the fiscal year approach, market observers note a significant trend: cash is slowly being deployed out the curve, a move often spurred by a shift in yield. According to insights from market professionals, tax-exempt money market assets are retracting, with a reported $132 billion currently on hand, down from the year’s early December peak of $137 billion. This decline suggests that investors are actively reallocating cash towards longer durations, consistent with the upward trajectory of yields.

Furthermore, a marked increase in weekly floater rates nearing 3.75%, which showcases a rise of 75 basis points in just two weeks, reinforces the notion that investors are exploring longer-term commitments as yields rise. Historical patterns indicate that durations beyond 2030 are witnessing significant trading activity, with inter-dealer trades dominating the secondary marketplace.

Looking ahead to 2025, expectations regarding economic indicators play a crucial role in shaping the outlook for the municipal bond market. Historical data suggests that election cycles can introduce an element of unpredictability; however, strategists believe that any proposed changes to fiscal and tax policies are unlikely to severely affect the municipal bond market’s foundations.

Nonetheless, potential changes in the tax-exempt status of certain bonds remain a subject of scrutiny. UBS strategists anticipate that while such changes could occur, they would likely not be widespread, diluting the negative impact on existing bonds by preserving their grandfathered status and subsequently enhancing their scarcity value.

Adding complexity to the landscape is the concern surrounding inflation, particularly in light of anticipated tariffs and a continued high fiscal deficit. Experts emphasize that while fiscal hawks within the Republican Party may temper aggressive fiscal policies, the potential for inflation to resurface could challenge the stability of the bond market.

On the supply side, UBS projects that tax-exempt supply will exceed $450 billion, spurred by a continuous demand for infrastructure investment. However, the waning fiscal aid for municipal issuers presents particular challenges that may strain their financial resources in the coming year. With the American Rescue Plan funds expected to run out, the potential for municipalities to misallocate resources into recurring expenses raises valid concerns.

Despite the recent pullback in values within the municipal bond sector, analysts maintain a cautiously optimistic outlook for future yields. The municipal-to-U.S. Treasury ratios are perceived to be on the higher end relative to historical averages, leading experts to speculate about their trajectory in 2025.

Although market conditions may remain stable in the near term, the prospect for AAA-rated municipal yields appears to lean toward a moderate decline as economic conditions evolve. Credit spreads are anticipated to hold tight as issuers confront a new reality of limited fiscal support. Consequently, the landscape for municipal securities heading into 2025 will be defined by not just macroeconomic shifts but also the resilience of issuers amidst changing fiscal demands.

The municipal bond market stands at a pivotal juncture, with the interplay of yields, economic indicators, and fiscal policies poised to shape its journey in the coming years.

Leave a Reply