The financial landscape is often influenced by economic indicators, monetary policy decisions, and industry-specific trends. One recent event that exemplifies this complex interplay was Federal Reserve Chair Jerome Powell’s announcement of a quarter-point interest rate cut, which initially rattled investors and contributed to a dip in stock prices. However, the market exhibited resilience, particularly towards the end of the week, with significant rebounds demonstrating the potential for recovery in specific sectors, such as semiconductors.

Interest rate adjustments by the Federal Reserve can have immediate and far-reaching effects on market sentiment. While a rate cut is typically seen as a measure to stimulate economic growth, the hawkish tone accompanying this announcement raised concerns among investors about inflationary pressures and future monetary tightening. This duality often leads to sharp market volatility, particularly in sectors sensitive to interest rates, such as technology and finance. Following this event, the markets initially plunged but quickly rebounded, revealing the often unpredictable nature of investor psychology and market sentiment.

Among the sectors that have shown promise following the Fed’s announcement is the semiconductor industry. Companies like Nvidia have been pivotal in this space, leading to increased buying interest as investors look for value amidst uncertainty. The uptick in Nvidia’s stock price signals a broader bullish momentum in the technology sector, potentially setting the stage for a Santa rally—a term used to describe a year-end market rally that often coincides with the holiday season.

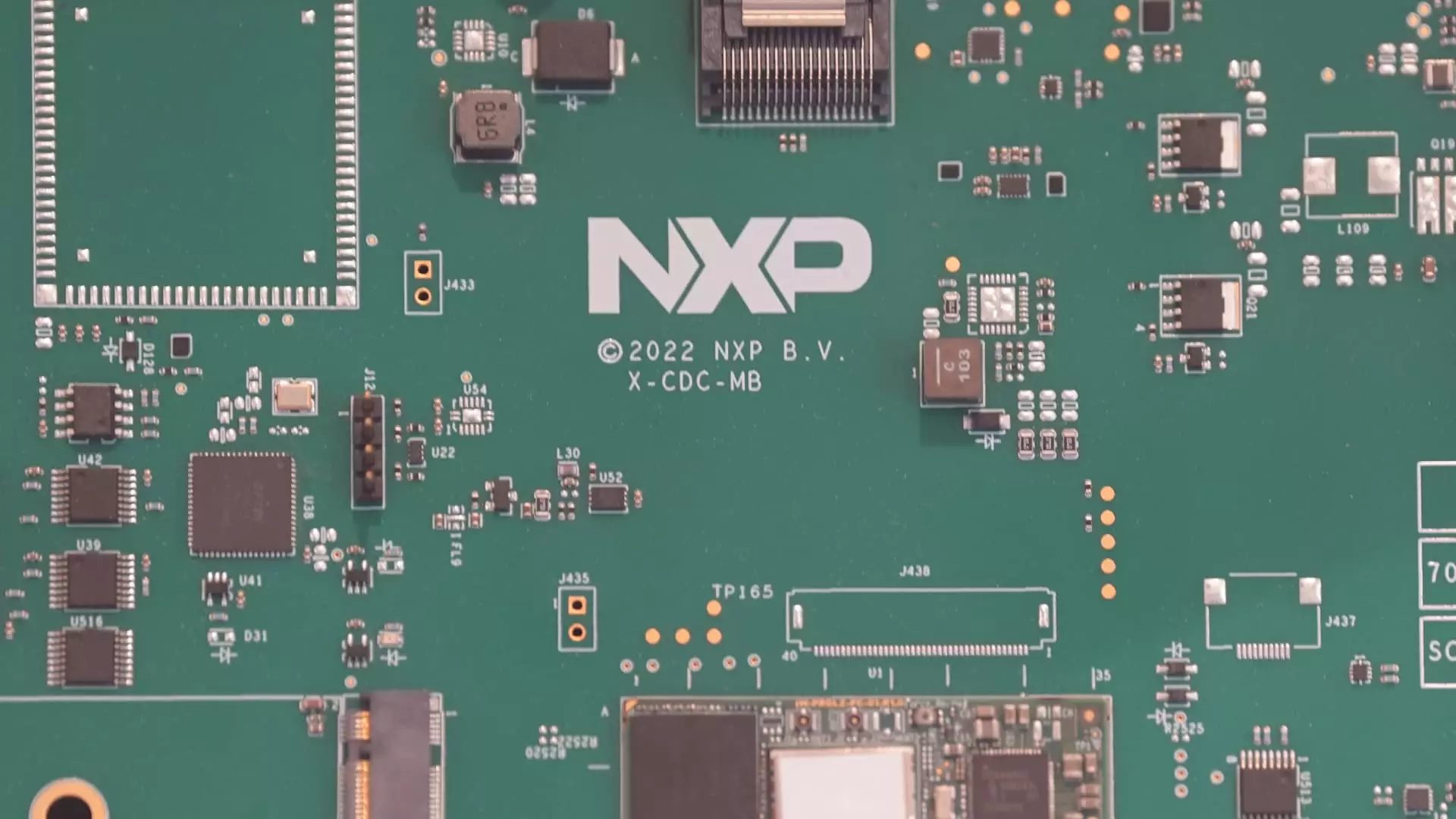

NXP Semiconductors NV stands out during this recovery phase, attracting attention due to its promising technical indicators. The company’s performance serves not only as an illustration of market dynamics but also as a case study for investors seeking opportunities within a fluctuating landscape.

To illuminate the investment potential in NXP Semiconductors NV, several technical indicators come into play. The Relative Strength Index (RSI) is a crucial tool that measures the speed and change of price movements. A recent upward shift in the RSI for NXP indicates a potential reversal of trend, suggesting that the stock may be gearing up for a bullish phase.

Additionally, the Directional Movement Index (DMI) provides insights into the strength and direction of a trend. A rising DMI could imply the conclusion of a prior downtrend, hinting at the emergence of a new upward trend—a key indicator for bullish traders. Furthermore, analyzing price action confirms these signals, as NXPI appears to be recovering from a recent low point, indicated by a series of closing prices represented by green candles.

For investors looking to capitalize on NXP Semiconductors NV’s potential rebound, constructing a bull call spread could be a strategic move. This approach involves purchasing a call option at one strike price while simultaneously selling another at a higher strike price, effectively hedging risk. In this scenario, one might consider buying a $210 call option while selling a $215 call option, both set to expire on January 17.

This defined risk strategy allows for a straightforward evaluation of potential profits against the capital at risk. Here, if NXPI trades at or above $215 at expiration, investors could see a considerable return on investment—effectively doubling their initial stake.

The market’s recent fluctuations exemplify the interconnectedness of economic policy and individual sector performance. As highlighted through the lens of NXP Semiconductors NV, investors are reminded of the importance of technical analysis in identifying meaningful entry points. Additionally, the cautious optimism surrounding sectors like semiconductors suggests that opportunities abound even amid broader uncertainties.

As always, traders and investors are encouraged to remain vigilant and informed, considering the unique aspects of their financial situations and seeking professional advice as needed. Making sound investment decisions requires not just understanding market dynamics, but also an awareness of one’s own risk tolerance and investment strategy.

Leave a Reply