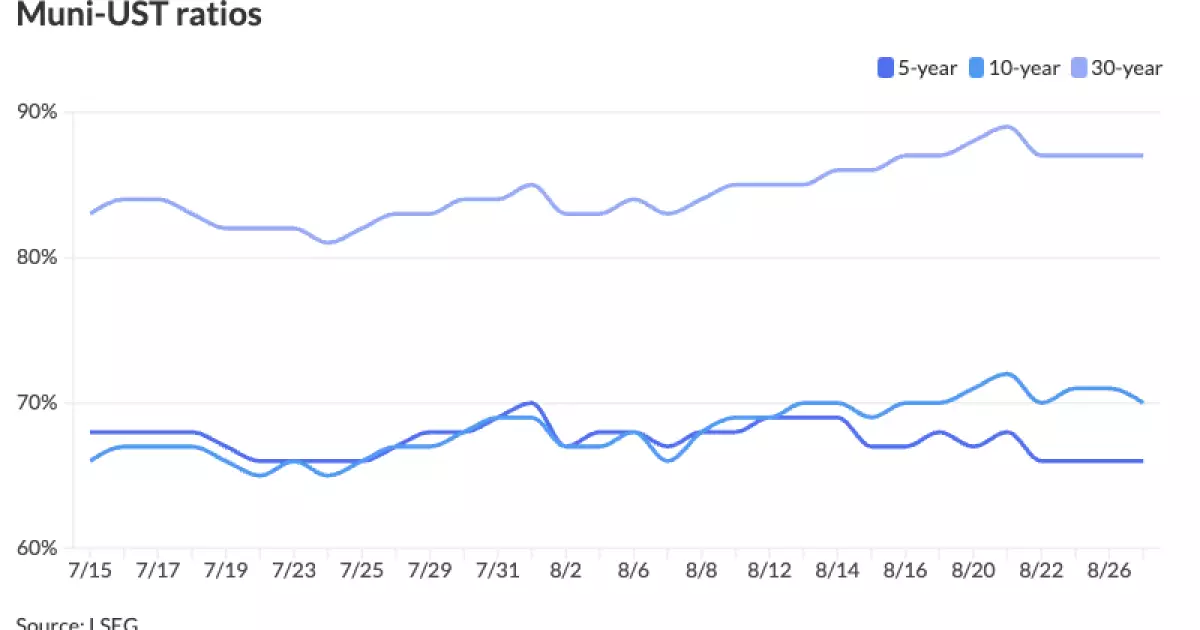

The municipal market saw a narrow mix on Tuesday, influenced by rising U.S. Treasury yields and a slightly higher equities market towards the close of the day. While the two-year muni-to-Treasury ratio stood at 63%, there was a slight variation in ratios for different maturities as per Refinitiv Municipal Market Data. This data was further corroborated by ICE Data Services, indicating a consistent trend in the market performance. As the Federal Reserve initiates rate cuts, it is expected that the Treasury market will continue to remain attractive, leading to positive outcomes for municipal bonds as well. Notably, AllianceBernstein strategists have expressed optimism by highlighting the municipal market’s potential for investors.

The primary market experienced substantial activity on Tuesday, with various institutions pricing deals worth millions in the municipal bond space. For instance, BofA Securities priced $2.616 million in general obligation bonds from California, offering a mix of yields across different maturity dates. Similarly, Morgan Stanley facilitated sizable deals for Northeastern University and Pennsylvania State University, underscoring the diversity of issuers in the market. Other notable entities like the Maine Health and Higher Educational Facilities Authority and the Rhode Island Commerce Corp. also engaged in significant bond issuances.

Forecast and Projections

Looking ahead, it is anticipated that issuance levels will remain heavy for the foreseeable future, pointing towards a continued influx of new bonds. Analysts like Vikram Rai from Wells Fargo have indicated upcoming gross and net issuance figures for the next month, suggesting a robust market environment. Despite concerns of a potential market overhang due to increased issuance, Rai believes that informed investors will capitalize on buying opportunities amidst heavy supply. Additionally, consistent inflows into muni mutual funds reflect sustained demand for municipal bonds, further supporting a positive outlook for the market.

Various yield curves and market indicators provide an insight into the municipal market’s performance. Refinitiv MMD’s scale, the ICE AAA yield curve, S&P Global Market Intelligence municipal curve, and Bloomberg BVAL display nuanced differences in yield percentages across different maturity timelines. Additionally, Treasury yields showed mixed trends during the day, reflecting the broader economic dynamics influencing the market. These indicators offer investors a comprehensive view of market conditions and potential investment opportunities.

Overall, Tuesday’s municipal market activity showcased a complex interplay of factors such as Treasury yield movements, issuer behavior, investor sentiment, and market projections. The market’s resilience in the face of changing economic conditions and policy decisions underscores its attractiveness to investors seeking stability and growth potential. As the market continues to evolve, staying informed about key trends and indicators will be crucial for investors navigating the dynamic landscape of municipal bonds.

Leave a Reply