The municipal bond market has been experiencing relatively stable prices despite the recent rise in U.S. Treasury yields and a downward trend in equities. While last year saw a negative total return for munis in the summer months, this year has shown a significantly improved performance with a return of 3.11% from June through August 16. Despite an increase in issuance, munis have outperformed the previous year, indicating a stronger technical picture.

Market participants have noted a breakneck pace in issuance, with a particular focus on avoiding election-related volatility in November. Large deals, such as the $1.8 billion issuance from New York City, have been absorbed well by the market. This is indicative of the overall constructive nature of the muni market, which continues to attract investors due to attractive yields. The market environment remains conducive for high-net-worth individuals looking to capitalize on higher yields.

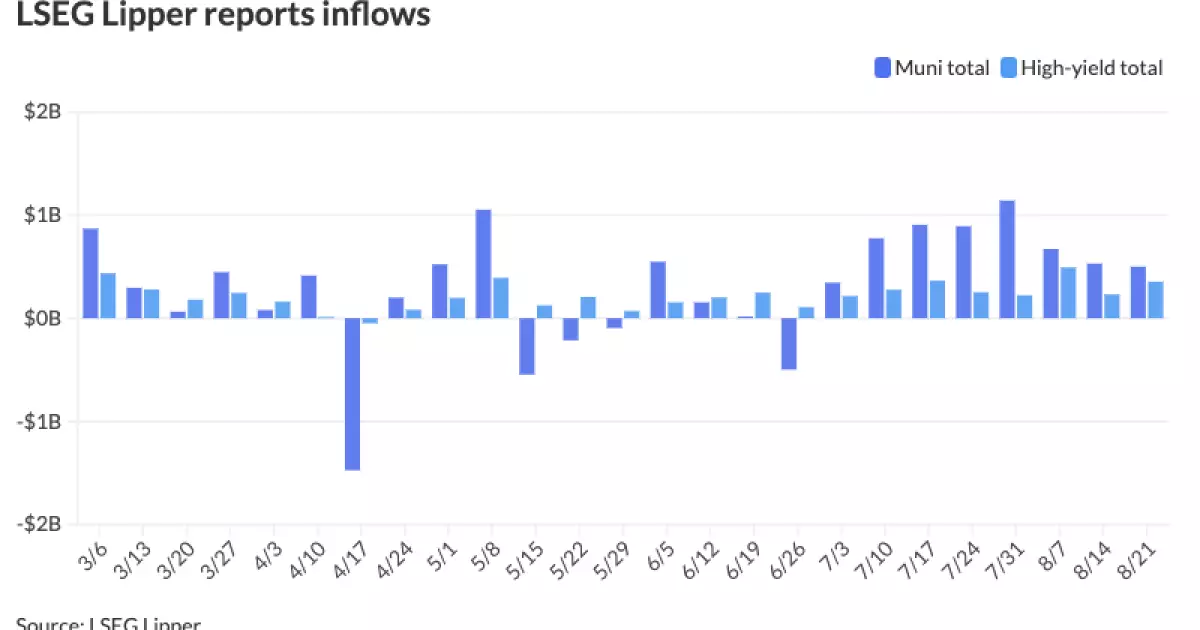

There has been a noticeable shift in investor behavior, with separately managed accounts (SMAs) showing significant growth. SMAs have been actively acquiring supply within the 15-year maturity range, reflecting a preference for shorter-end maturities. Muni-UST ratios have also been on the higher side, further incentivizing investors to lock in favorable yields. Additionally, municipal bond mutual funds have seen consistent inflows in recent weeks, marking a positive trend after years of outflows.

Speculation around a potential rate cut by the Federal Reserve has been a focal point for market participants. The minutes from the July FOMC meeting indicated a willingness to consider rate cuts in the upcoming months. However, the uncertainty surrounding the timing and extent of the rate cut has led to varying interpretations among market strategists. The market is eagerly awaiting further guidance from the Fed, particularly regarding Chair Powell’s upcoming appearances.

In the primary market, notable bond issuances have taken place, including deals from Dallas and Fort Worth, Texas, Los Angeles County Public Works Financing Authority, and Charlotte, North Carolina. These offerings have showcased varying yield levels across different maturities, reflecting the diverse nature of municipal bonds. Despite fluctuations in yields and repricings, the primary market has remained active, catering to the demand from both institutional and retail investors.

Various sources, including Refinitiv MMD, ICE Data Services, S&P Global Market Intelligence, and Bloomberg BVAL, provide insights into the municipal bond yield curves. The yield levels have remained relatively stable, with slight changes observed across different maturities. The overall trend indicates a cautious approach from investors, as they closely monitor interest rate movements and market dynamics.

The municipal bond market has shown resilience in the face of firmer Treasury yields. Despite the upward trajectory in Treasury rates, munis have remained steady, attracting investors with their comparatively higher yields. The relationship between Treasury and muni yields continues to influence investor decision-making, with a keen focus on relative value and risk-adjusted returns.

The municipal bond market has displayed a mix of stability and resilience amidst changing market conditions. While uncertainties regarding future rate cuts and economic indicators persist, investors continue to find opportunities in the muni market. The evolving dynamics of issuance, investor behavior, and fund flows underscore the importance of staying informed and adaptable in navigating the complex landscape of municipal bonds.

Leave a Reply