As we approach the next fiscal year, Oracle Chairman Larry Ellison stands on the precipice of becoming the world’s wealthiest individual, outstripping other tech moguls such as Amazon’s Jeff Bezos and Tesla’s Elon Musk. Predictions suggest that Ellison’s fortune might soar to an astounding $206.5 billion, fueled by his extensive holdings in Oracle, which currently amount to approximately 1.1 billion shares. The optimism comes as Oracle’s shares have surged nearly 60% in 2024, marking what could potentially be their strongest year since 1999. This surge can be attributed to the remarkable growth of artificial intelligence (AI), which has become a revolutionizing force across multiple tech sectors.

Ellison’s adeptness in targeting market trends has earned him accolades from financial analysts. Kim Forrest, chief investment officer at Bokeh Capital Partners, remarked on his unique talent for identifying what is “hot” in the market and committing resources to capitalize on these trends. However, while analysts rave about Oracle’s current momentum, there is speculation about the long-term sustainability of this growth. The allure of AI may have bolstered Oracle’s standing, but its future success largely hinges on how well the company can integrate this technology into its existing software solutions.

The excitement around AI has not been confined to Oracle alone; the technology sector as a whole has thrived on the back of this enthusiasm. Since the introduction of AI-driven applications like ChatGPT in late 2022, stocks across various tech companies have witnessed substantial growth, with many companies reaping the benefits of increased public and investor interest. Furthermore, the Federal Reserve’s recent shift towards rate cuts has the potential to bolster this growth trajectory even further. Lower borrowing expenses could encourage companies to invest in expansion, thereby further enhancing the prospects for tech stocks.

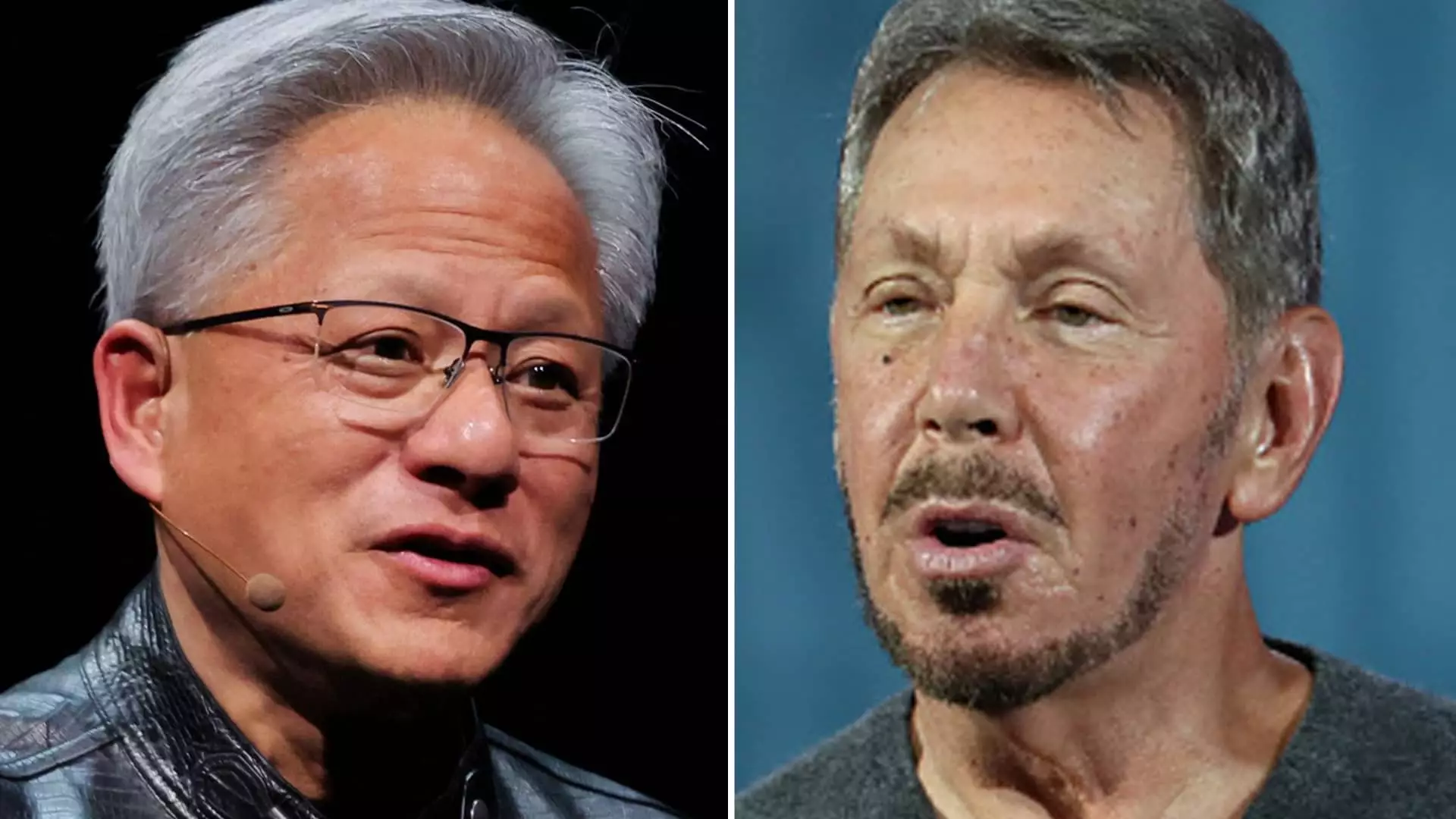

With Oracle capitalizing on this trend, other tech titans are also positioning themselves for success. Amazon’s shares, for instance, are projected to grow by 16% this year, potentially adding over $27 billion to Jeff Bezos’s wealth, and bringing his fortune up to about $203.9 billion. Similarly, Nvidia has seen a remarkable 135% increase in stock value, primarily due to its association with AI innovations. CEO Jensen Huang’s stake is forecasted to rise significantly, which places him in a solid position compared to other industry leaders.

As the battle for the title of the world’s richest individual intensifies, the competition between these tech billionaires becomes increasingly fascinating. Musk, who currently occupies a top position, could experience a downturn in stock value as Tesla faces adversities such as increased competition and falling share prices. Estimates suggest a potential reduction of nearly 11% in his wealth, which could leave him with approximately $89.6 billion.

In contrast, Ellison’s approach with Oracle aims to capitalize on innovative markets, while Bezos continues to dominate the e-commerce landscape. These variances in strategy highlight the complexities of their respective journeys, showcasing the unique qualities that have propelled their fortunes. Ellison’s capacity to pivot toward AI is a notable distinction that could very well shape the upcoming year, lending him credibility that rivals the reputations built by his peers over decades.

While projections suggest Ellison may soon claim the title of the richest individual due to significant gains from Oracle’s share price, several dynamics are at play that could alter the course of these predictions. The tech industry is notorious for its volatility, and the landscape can shift rapidly based on external economic conditions and evolving market sentiments.

As Ellison, Bezos, Musk, and Huang continue to navigate this competitive environment, it’s essential to remain vigilant in monitoring not just their successes, but also the hurdles that each faces. The forthcoming year stands as a testament to resilience and adaptability, with the potential to redefine the balance of wealth within the tech sector. The future might bring unforeseen challenges, but with innovation at the helm, these figures remain pivotal in steering the technological narrative forward.

Leave a Reply