As we delve deeper into the financial landscape of 2024, it’s evident that bond insurance remains a critical component of the debt market, particularly for municipal bonds. The first three quarters of the year have shown remarkable resilience and growth, with bond insurance wrapped around $28.921 billion in debt—an impressive 26.8% increase from the previous year. This article will explore the factors contributing to this robust demand, the performance of leading bond insurers, and the broader implications for the municipal bond market and its investors.

The data paints a compelling picture of the bond insurance market as we conclude the third quarter of 2024. Municipal bonds insured increased significantly from $22.814 billion to $28.921 billion, underscoring a surge in investor confidence. Moreover, the number of deals surged from 995 to 1,217, indicating a healthy appetite for securing these financial instruments.

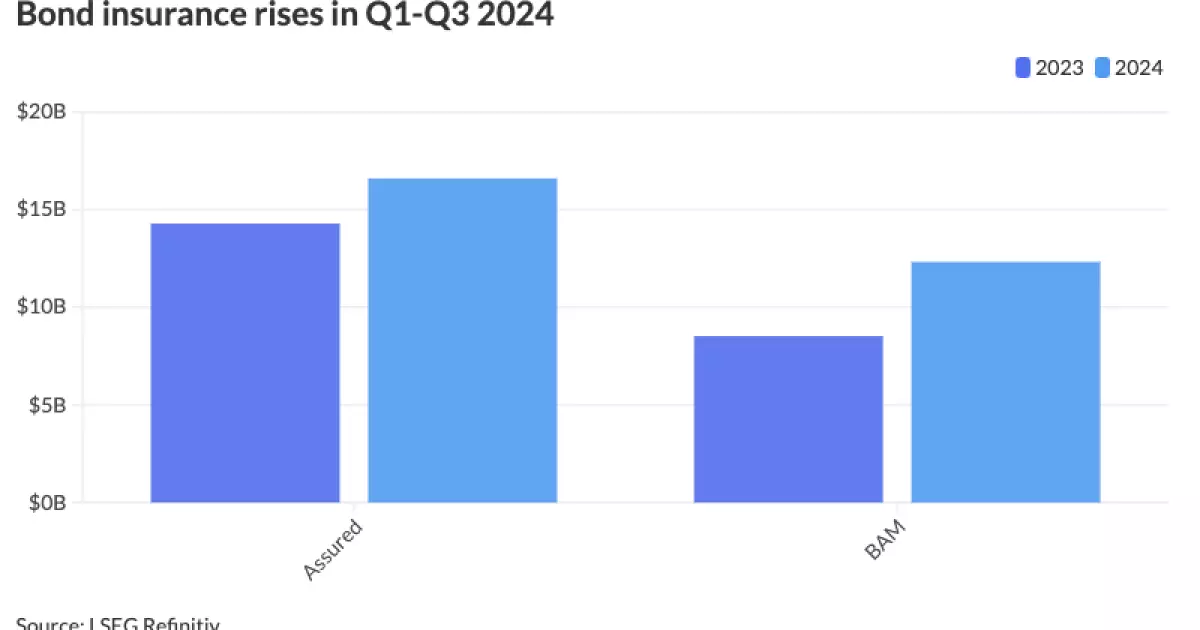

This uptick in activity is not a coincidence; it is emblematic of a recovering market that is not merely surviving but thriving. Both major bond insurers—Assured Guaranty and Build America Mutual (BAM)—reported year-over-year growth, with Assured Guaranty’s market share standing at 57.4% and BAM at 42.6%. These statistics reveal a competitive landscape fueled by increased issuance and investor interest.

Assured Guaranty emerged as the clear leader by insuring $16.599 billion across 561 transactions, which attests to its critical role in the market. Notably, the firm engaged in high-value deals, including significant projects such as the Brightline Florida passenger rail initiative and the renovation of New Terminal One at John F. Kennedy Airport. The presence of substantial fluctuations in deal size—evidenced by 33 insured deals exceeding $100 million—highlights the insurer’s ability to adapt to large-scale projects that require substantial backing.

On the other side, BAM’s performance with $12.322 billion across 656 deals indicates a growing influence in the market. Their focus on partial insurance for large transactions showcases a strategic response to evolving market dynamics. The fact that BAM’s insured amount for the first nine months of 2024 already surpasses its total from the entire previous year further reflects the insurer’s operational success and adaptability in challenging conditions.

One of the most significant takeaways from this growth narrative is the underlying sentiment of investors, particularly institutional players. The surge in interest for bond insurance can be attributed to a confluence of factors: heightened demand for infrastructure financing, geopolitical uncertainties, and the necessity of risk mitigation. As Robert Tucker, Senior Managing Director at Assured Guaranty, pointed out, the strong demand for insurance from institutional investors is a critical element driving the market forward.

The growth in bond issuance can also be seen as a mechanism for generating capital in a time fraught with economic unpredictability. As institutions seek safer investment options, bond insurance becomes an attractive avenue, offering both financial safety and competitive pricing.

As we move further into 2024, the current growth trajectory of bond insurance suggests that investors are laying the groundwork for a more robust municipal bond market. Strong institutional interest, particularly in high-rated and larger transactions, is likely to persist, which points to sustained growth for bond insurers. With further advancements in the underwriting of risk and innovative insurance structures, the bond insurance market is well-positioned to navigate through economic fluctuations.

Moreover, the heightened focus on infrastructure investments is likely to remain a focal point, providing ample opportunities for bond insurers to engage with clients in meaningful ways. As firms like Assured Guaranty and BAM continue to diversify their offerings, they will adapt to ever-evolving market needs, ensuring their relevance in a dynamic investment environment.

The bond insurance market has showcased remarkable resilience and growth during the first three quarters of 2024. An increase in the amount of debt wrapped by bond insurance, strong performance from key players, and favorable investor sentiment highlight a market poised for further success. The commitment from both insurers to enhance their services in response to investor demand signals a bright horizon for the bond insurance landscape, suggesting that its role will only grow more significant in the finance industry going forward.

Leave a Reply