The municipal bond market has recently exhibited increased volatility as market dynamics shift with investors navigating fluctuating economic conditions. As we observe the interplay of municipal yields, U.S. Treasury performance, and equity market movements, it becomes evident that several key factors are influencing the current state of affairs in fixed-income securities. In this analysis, we will dissect these trends and explore their implications for investors moving forward, particularly with the upcoming presidential election on the horizon.

On Wednesday, municipal bonds experienced a slight downturn, marking the fourth consecutive session of losses. This downturn aligns with an increase in U.S. Treasury yields, which further complicates the landscape for municipal bond investors. According to data, municipal bond yields were elevated by up to three basis points, while U.S. Treasuries saw a rise of four to five basis points, pushing the yields of two-year U.S. Treasuries above the 4% mark for the first time since late August. This development raises questions about the attractiveness of municipal bonds compared to Treasuries, especially at a two-year muni-to-Treasury ratio of approximately 61%.

The investor behavior in this changing landscape is noteworthy. The recent uptrend in Treasury yields could attract investors seeking higher returns, thus fueling a shift in demand. A higher yield can lure institutional and retail buyers towards Treasuries, potentially sidelining municipal investments unless they offer compelling value.

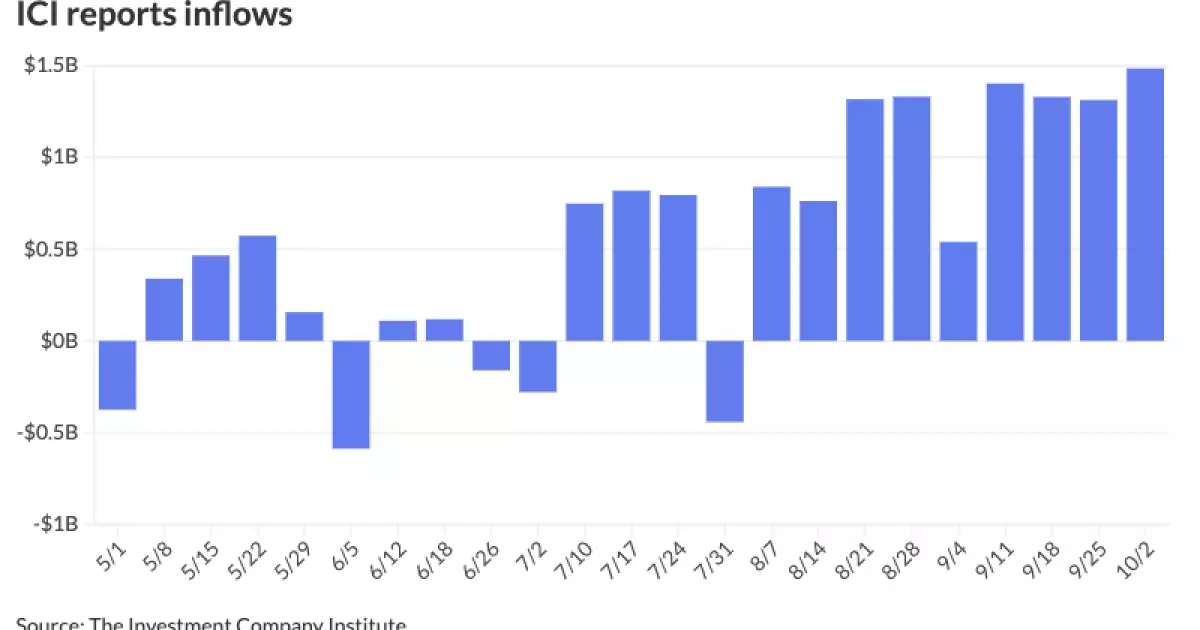

Despite the slight weakening in municipal bonds, the investment community remains optimistic about the sustained inflows into municipal bond mutual funds. In the week ending October 2, inflows totaled $1.484 billion, building on the previous week’s momentum of $1.312 billion. Notably, this marks the ninth consecutive week of inflows, with four of those weeks exceeding $1 billion.

Exchange-Traded Funds (ETFs) also displayed robust activity with $810 million in inflows after a previous $109 million. These figures underscore enduring investor interest in municipal securities, contributing to a more dynamic market despite the fluctuations in yields. Analysts suggest that the substantial demand is bolstered by reinvestment needs and favorable ratios, hinting at a resilience in the municipal market even amid broader economic uncertainties.

As the fourth quarter unfolds, the municipal bond market’s trajectory is anticipated to be shaped by a variety of factors, including fiscal policy shifts and broader economic indicators. Analysts, including Jeff Lipton from a notable financial institution, pointed out that the prevailing environment reflects a transitional phase as municipalities front-load their issuance ahead of the impending presidential election. The anticipation surrounding electoral outcomes often influences the timing and volume of bond offerings, as issuers strive to capitalize on investor demand prior to potential shifts in market sentiment.

Additionally, while the pace of issuance has accelerated significantly, the influx of supply, surpassing the $10 billion weekly mark (excluding certain shortened weeks), prompts a need for critical evaluation among investors. Daryl Clements, a municipal portfolio manager, highlighted the importance of discerning investment opportunities amid a slightly elevated valuation landscape. As market participants adjust their strategies, the potential for selectivity among investors could redefine the competitiveness of price points and yield offerings in the municipal market.

In light of the current environment, the prospect for municipal investors appears cautiously optimistic. While the near-term outlook is clouded by continued volatility, there are strategic opportunities on the horizon. The potential for attractive buying moments is heightened by relative value considerations, especially as some investors might focus on taxable equivalent yield calculations.

As the market prepares for potential subduing of supply due to the upcoming election, savvy investors will need to remain vigilant to identify optimal entry points. The convergence of strong demand, coupled with manageable reinvestment requirements for the remainder of the year, may well produce moments where munis become more appealing as yields adjust.

As the municipal bond market continues to navigate the complexities of economic shifts and investor sentiment, the resilience of this market segment should not be underestimated. Inflows are a testament to sustained interest, and while fluctuations are inevitable, opportunities for prudent investing abound. Investors who maintain a strategic outlook and adaptability may find themselves well-positioned in this evolving landscape.

Leave a Reply