The municipal bond market has recently demonstrated a steady performance, as evidenced by various market indicators and recent transactions. This article seeks to provide a critical analysis of the state of the municipal bond market amid changing economic conditions and evolving patterns of investor behavior. By understanding these dynamics, investors can better navigate the complexities of purchasing municipal bonds and optimize their investment strategies.

Market Stability Amidst Volatility

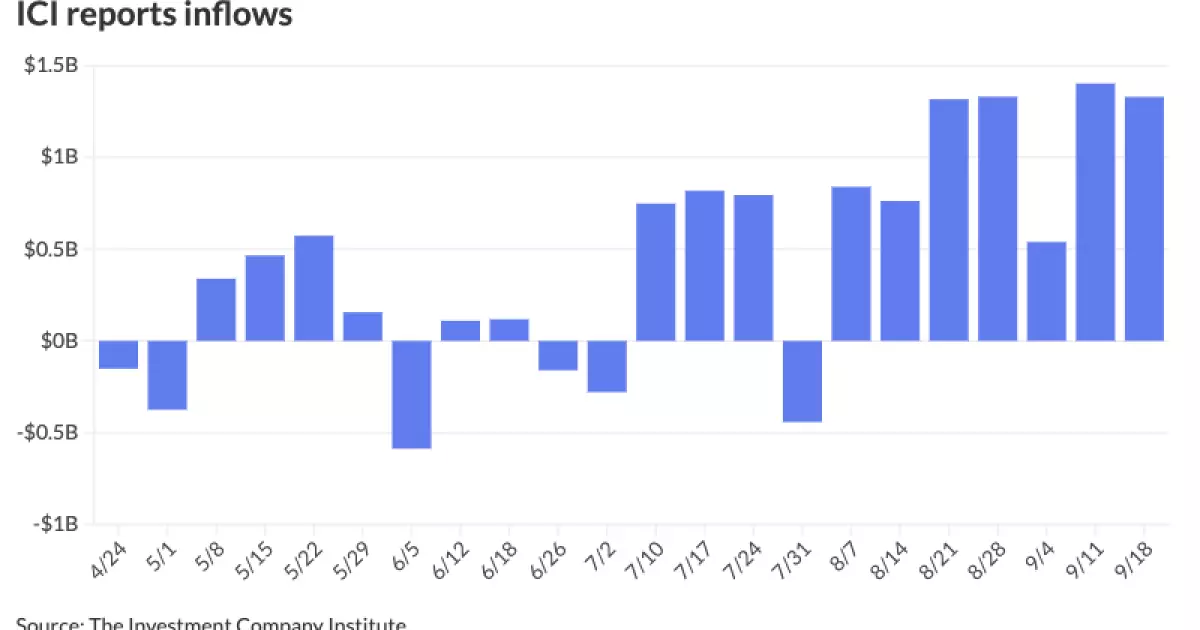

The municipal bond market has shown a degree of resilience as the primary market has drawn considerable attention with several significant deals leading to lower yields upon repricing. This development is particularly notable against the backdrop of moderately weaker U.S. Treasuries and declining equity markets. The Investment Company Institute reported a notable inflow of $1.329 billion into municipal bond mutual funds for the week ending September 18, following a slightly higher inflow of $1.402 billion the week prior. However, there has been a noticeable decrease in inflows for exchange-traded funds, which dropped to $55 million from $1.048 billion the previous week.

As summer transitions into fall, market analysts at Appleton Partners expressed concerns regarding the reduction of reinvestment capital that has traditionally buoyed municipal investments during the summer season. Analysts predict that the lack of such reinvestment capital could lead to increased volatility as the year progresses, especially around seasonal spikes in issuance.

Throughout the past several months, issuance in the municipal bond market has remained remarkably robust, with approximately $14 billion of supply emerging recently. Notably, Tuesday’s primary market activity featured two billion-dollar deals and substantial upsize for New York-related bonds. Wednesday continued this trend with several large new issuances that saw rates decline in repricing.

Year-to-date issuance has amounted to $357.913 billion, reflecting a significant 37.7% increase compared to the previous year. Analysts attribute this substantial uptick to an increased sense of urgency among issuers, spurred by impending market volatility linked to the upcoming presidential elections. Financial experts like Jon Mondillo, global head of Fixed Income at abrdn, articulated that issuers are seeking to navigate the upcoming fiscal uncertainties that could arise from election outcomes, emphasizing the importance of acting decisively before November 5.

Despite the challenges facing the market, analysts posit that the interplay of increased issuance and diminished reinvestment demand could create lucrative opportunities for municipal bond buyers. The 10-year muni-to-U.S. Treasury ratio currently hovers around 70%, potentially rising if supply continues to outpace demand. Such an increase could enhance the appeal for investors seeking value in the municipal segment.

As of Wednesday, specific ratios were reported for various maturities: the two-year ratio stood at 65%, the three-year at 66%, and the 30-year at an elevated 85%. These ratios suggest that munis are trading at relatively tight spreads compared to Treasuries, particularly for longer maturities. Mondillo highlighted that this may reflect a “new normal” in yield ratios, contrasting sharply with times when long-end ratios exceeded 100%. Future trends will depend largely on Treasury yields, which would need to decrease for ratios to align more closely with historical averages established during periods of low interest rates.

In the primary market, BofA Securities priced $1.061 billion in consolidated bonds for the Port Authority of New York and New Jersey, with several maturities reflecting lowered yields from Tuesday’s pricing. Additional issuances included $700 million of revenue bonds for the Salt River Project Agricultural Improvement and Power District, showcasing a trend of increased yield adjustments during pricing to attract buyers.

Other highlights involved significant school district bonds in Texas and airport revenue bonds in South Carolina, both illustrating the ongoing demand for municipal financing. As municipalities invest in critical infrastructure, the market has become increasingly responsive to yield adjustments, enabling institutions to secure financing while remaining competitive amid shifting demand dynamics.

As the municipal bond landscape evolves, investors must remain vigilant and adaptable. The interplay between issuance, reinvestment demand, and broader economic conditions will dictate market performance in the coming weeks and months. With the backdrop of fiscal uncertainty looming from the upcoming elections, now is the time for investors to clarify their strategies, evaluate potential opportunities, and align their portfolios in anticipation of the shifting tides in the municipal bond market. By leveraging the insights shared in this analysis, stakeholders can strive for informed investment decisions that capitalize on the nuances of the current market environment.

Leave a Reply