Municipal bonds have long been a critical component in the investment portfolios of many bondholders, providing a safe haven in uncertain economic times. Recently, however, the municipal bond market has faced fluctuations that could have profound impacts on its investors. This article aims to unpack the current dynamics affecting municipal bonds, especially in light of recent changes in U.S. Treasuries, and offer insights into the strategies investors may consider in this shifting landscape.

On a recent Thursday, municipal bond yields presented a mixed picture despite overall volatility in the financial markets. Indeed, while U.S. Treasuries saw some movements—losses at the front end of the curve and gains in the longer maturities—certain municipal bonds experienced subtle shifts. Yields varied, showing adjustments up to three basis points based on different maturities, conveying a relatively muted week after an initial flurry of reactions to the election results.

The calm on the municipal front was notable given the turbulence seen in sectors that tend to influence municipal performance. As BlackRock strategists have pointed out, the impending volatility is likely to persist, stemming from the uncertain repercussions of election outcomes and the future direction of Federal Reserve policy. While this could cast shadows on investor confidence, the municipal market may hold strong, supported by declining new issuance and favorable seasonal trends as we approach year-end.

To better understand the current situation, we can draw parallels with similar periods in the past. Investment guru Kim Olsan pointed out the current market’s volatility resembles that seen in November 2016. During that month, generic yields rose by 50 to 70 basis points. This historical lens aids in contextualizing the current dynamics, especially since fluctuations in U.S. Treasury yields often exert influence over municipal bond flows. The absence of competitive yields, particularly in the range between 2026 and 2032, further complicates the landscape for investors seeking better relative values.

As of now, about 16% of tax-exempt trades have occurred within that range, suggesting that many investors are not finding the returns they desire in munis, particularly compared to U.S. Treasuries. Thus, with the two-year municipal-to-Treasury ratios settling around 60%, investors are left contemplating the risk and reward of their bond holdings in various maturity buckets.

Investors should approach the municipal bond market with a critical eye, particularly regarding callable bonds and intermediate maturities. Olsan has highlighted that pre-refunded bonds due in 2025 are sticking to the 3.00% yield level, which can serve as a feasible option for those exploring defensive strategies. Meanwhile, bonds featuring callable options for 2025-2027 may offer compelling yields, giving investors additional layers of flexibility amid anticipated rate volatility.

However, some hesitancies exist amongst potential buyers, as expectations of heightened supply towards the end of 2024 loom large. On average, the months of November and December typically see significant issuance levels, approaching $60 billion total in recent years. Yet, with current rate volatility, the appetite for issuing new bonds could cool, thereby influencing yield trajectories in the secondary market.

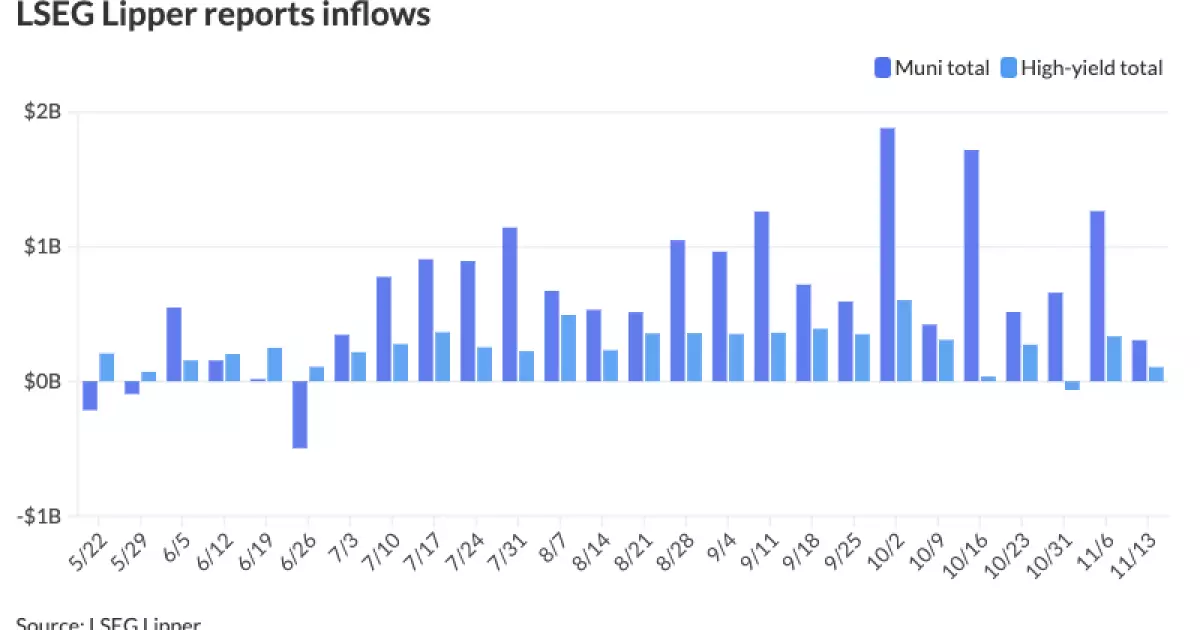

An essential aspect to consider in the broader municipal market dynamics is the trend in fund flows. Recently reported inflows into municipal bond mutual funds remained positive, echoing a resilient yet cautious sentiment among investors. While the recent addition of $305 million reflects a continual interest, it’s critical to note that this marks a decrease compared to previous weeks—indicating a potential shift in investor sentiment.

The high-yield segment particularly experienced a more pronounced shift, transitioning from previous outflows to modest inflows. Both trends suggest a complex sentiment within the market: while investors continue to seek refuge in municipal bonds, the fluctuating environment may keep them on alert for yield pressure.

As the end of the year approaches, the municipal bond market faces various conflicting forces. With a backdrop of uncertain monetary policy and sporadic Treasury fluctuations, investors must carefully evaluate their positions and strategies. The potential decrease in new issuance and the continued search for favorable yields will remain critical factors in determining future market performance.

Investors should be equipped with strategies to navigate these complexities, leveraging historical insights while remaining vigilant to changes in market conditions. Whether through tactical adjustments in their portfolios or enhanced scrutiny of market trends, being adaptable could prove indispensable as the dynamics of the municipal bond market continue to evolve.

Leave a Reply