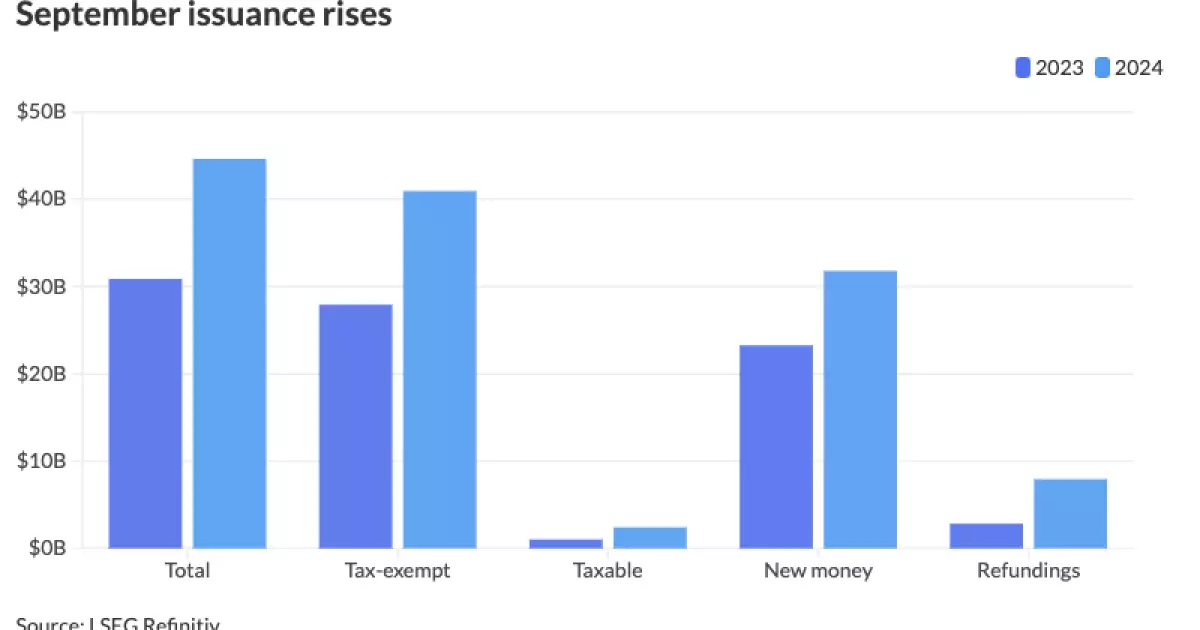

The landscape of municipal bond issuance in 2024 has taken a striking turn, potentially setting the stage for unprecedented market activity. September of this year was noteworthy, surpassing previous records and showcasing an impressive 44.5% increase compared to the same month last year. This increase was fueled largely by state and local governments capitalizing on favorable economic conditions and the depletion of aid programs established during the pandemic. According to insights from LSEG data, the total issuance for September alone reached an astounding $44.628 billion across 752 transactions, a significant leap from the $30.88 billion recorded in September 2023.

This remarkable growth can be attributed to a confluence of factors influencing issuers to flood the market with new offerings. Not only is the 2024 issuance already nearing last year’s total, but it also highlights a growing momentum that has characterized the market throughout the ninth month of the year.

As of September 2024, the year-to-date bond issuance volume stands at $380.423 billion, marking an impressive 35.2% increase relative to the same period in 2023. With only three months left in the calendar year, the market is positioned on the brink of surpassing $384.715 billion, the entirety of last year’s issuance. However, it remains to be seen if the pace can maintain momentum. To eclipse the 2020 record of $484.601 billion, issuers would need to generate over $104 billion during the final quarter, a task that will challenge even seasoned market participants.

Henry Smith, an analyst at Greenberg & Associates, points out that this surge in volume does not appear coincidental. “Governments are leveraging favorable financing terms and an investor base that is eager to deploy cash, particularly with interest rates that remain relatively inviting,” he notes. The conditions are indeed ripe for issuers, with many already stepping up their activities ahead of a potentially turbulent election cycle.

The recent months have witnessed an influx of “mega deals” making their way into the market, including several high-value offerings significantly boosting overall issuance. Deals such as the $1.6 billion general obligation bonds from Washington, D.C., alongside substantial revenue bonds from the Texas Water Development Board and the New York City Transitional Finance Authority, exemplify this trend. Analysts suggest that the remarkable acceptance of large-scale offerings reflects the robust demand from investors, which in turn allows issuers to push the envelope further than in years past.

Drew Gurley, a managing director at Siebert Williams Shank, emphasizes the psychological shift among issuers. “Issuing billion-dollar deals is no longer an anomaly. The market is selling off such deals rather comfortably, indicating a strong institutional appetite,” he explains, signaling a noteworthy evolution in refinancing and capital raising strategies among municipalities.

An observed pattern among issuers is the strategic timing of market entries, particularly as elections approach. Historical data reveals that significant issuance often peaks in the months leading up to an election—a strategy intended to circumvent volatility reminiscent of past election cycles, such as those in 2016 and 2020. This year is no exception, with numerous issuers seeking to capitalize on favorable conditions well before the November elections.

The collective sentiment among market analysts underscores a dual-phase approach: the immediate rush of issuances preceding the election and a potential lull directly following, as the market adjusts to the results. “Expectations are that there will be a noticeable dip in the issuance during the latter part of October, but it should rebound fairly quickly as issuers focus on meeting their financial needs going into the holiday period,” states Gurley.

Diving deeper into state-level contributions, the data reveals Texas leading the pack in 2024 issuance, accounting for over $56 billion—a remarkable 12.5% increase year-over-year. Following closely is California, reflecting an upward shift of 36.1%, while New York rounds out the top three with a striking 50.5% increase. Other noteworthy contributors include Florida, experiencing a staggering 117.8% increase, underscoring the diverse regional dynamics influencing the municipal bond market.

Furthermore, the rise in negotiated deal volume showcased a substantial 43.5% increase, suggesting a continuing trend towards customized offerings over competitive sales, which saw a dramatic uptick of 101.1% compared to last year.

As the end of 2024 looms, market observers remain alert to the intricate dynamics at play within the municipal bond sphere. The anticipated pipeline of new issuances, coupled with a more flexible investor base comfortable with mega deals, sets the stage for sustained activity. However, the ultimate question looms: Will the market be able to exceed its previous peaks, or will external factors rein in the current momentum? The next few months will be critical in defining not just the performance for the remainder of the year, but also the broader implications for future municipal financing strategies.

Leave a Reply