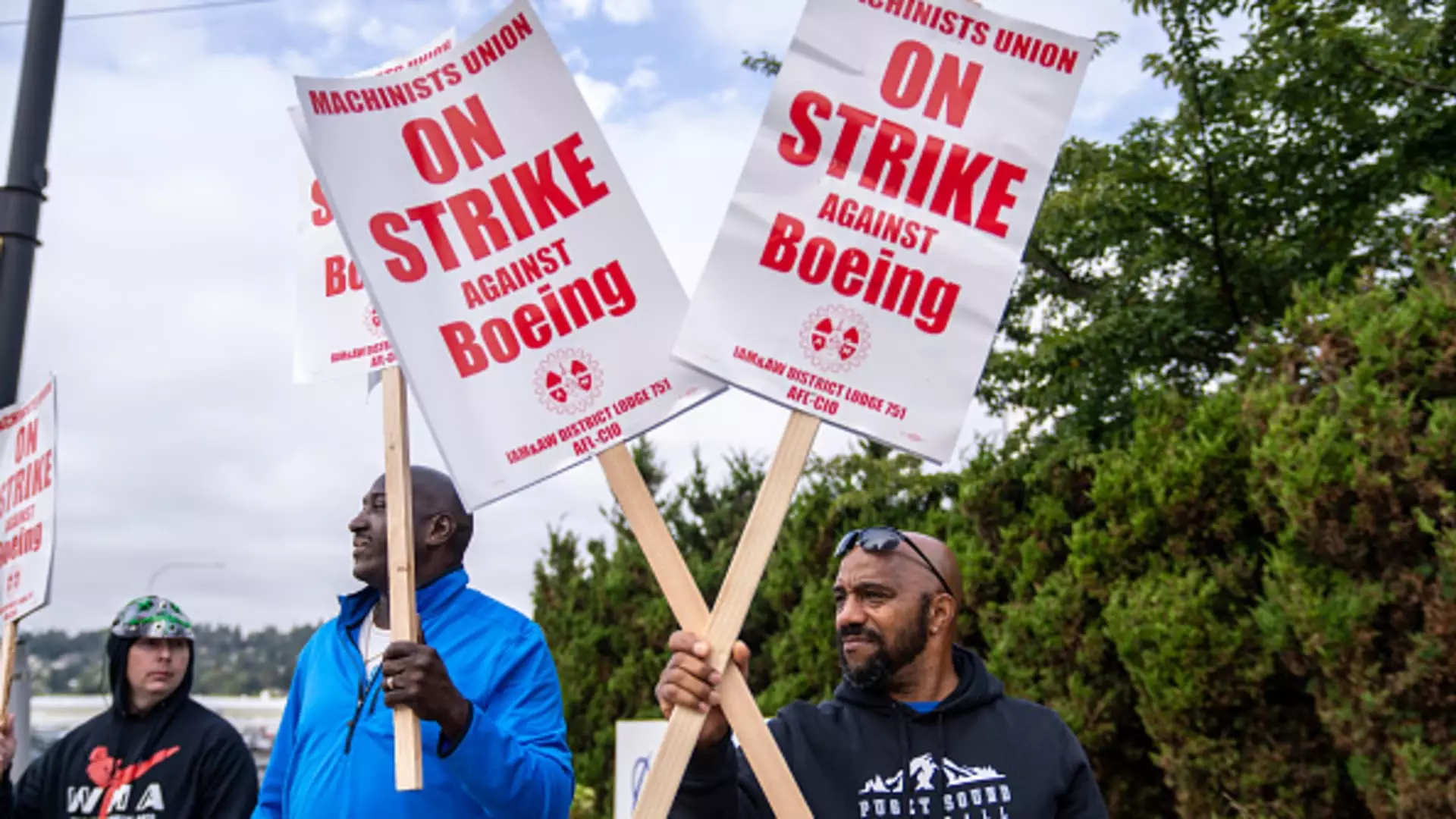

In the wake of a significant labor dispute, Boeing finds itself grappling with the ramifications of a strike involving over 30,000 machinists. These workers ceased operations after overwhelmingly rejecting a proposed contract, marking a critical moment for both the company’s leadership and its financial stability. The strike comes at a time when Boeing was already navigating a series of challenges, including the disastrous operational flaws of the 737 Max and other production concerns. The cumulative effect has pressured new CEO Kelly Ortberg, who is tasked with restoring confidence and mitigating losses in a climate filled with uncertainty.

As tensions escalate, the financial impact is stark, with estimates suggesting the strike could be costing Boeing upwards of $1 billion per month. This unsustainable expenditure exacerbates existing difficulties the company faces, including a lack of profitability that has persisted since 2018. With operations temporarily halted at several factories across key locations, it appears that the labor strife may inflict long-term damage on Boeing’s already tarnished reputation in the aerospace sector.

As efforts to reach an agreement have stalled between Boeing and the International Association of Machinists and Aerospace Workers (IAMAW), both sides appear entrenched in their positions. The union’s rejection of the previous contract offer, which was intended to be more favorable, was met with surprises by company officials who had initially communicated a sense of optimism regarding negotiations. Unfortunately, this optimism proved to be misplaced, as workers staunchly opposed the terms laid out in the proposed deal.

Amidst this turmoil, Professor Harry Katz, an expert in labor relations, asserts that the union will ultimately require a more robust offer from Boeing to end the strike. However, one of their key demands—a reinstatement of the pension plan—is likely to remain off the table, illustrating the complexities involved in collective bargaining processes. In recent developments, Boeing has accused the union of negotiating in bad faith, leading to further complications in the relationship between management and workers.

As Boeing navigates its current challenges, the company faces the humiliating prospect of cutting its workforce by approximately 10%. This decision follows a series of poor financial forecasts, including an expected loss of nearly $10 per share for the third quarter. The painful reality is compounded by high-profile delays, notably concerning the 777X aircraft, which has seen its delivery timeline pushed back by an additional year to 2026.

These drastic measures represent a radical shift for Boeing as the company attempts to recalibrate its focus. With the stock market reacting negatively to these developments, shares have plummeted by 42% within the year, leaving investors questioning the company’s ability to rebound effectively from ongoing crises. Despite Ortberg’s assurances of restoring focus on core competencies, there remains an unsettling feeling that Boeing may lack the capacity to execute real change in the wake of such turmoil.

The Ripple Effect on Supply Chains and Future Prospects

The uncertainty surrounding Boeing’s labor relations and financial health is unlikely to be contained within the company’s walls. The ramifications extend into its broader supply chain, where partners like Spirit AeroSystems contemplate furloughing workers in response to reduced orders from Boeing. Such measures across the supply chain can result in compounded disruptions that reverberate throughout the industry, further heightening risk.

AeroDynamic Advisory’s Richard Aboulafia emphasizes the need for Boeing to stabilize its production processes, particularly concerning the 737 Max, which is crucial for the company’s financial recovery. However, the current trajectory indicates that management decisions, including layoffs, risk exacerbating the very inefficiencies the company aims to rectify. The paradox of cutting workforce components that are vital to operational success raises serious concerns regarding Boeing’s strategic direction.

As Boeing’s workforce remains on strike and financial concerns mount, the question persists: how long can this standstill endure without irreversible damage? With critical discussions regarding labor negotiations continuing to unfold, stakeholders from the company to the unions will need to pursue genuine dialogue aimed at reconciliation. Ultimately, only a collaborative resolution will pave the way for Boeing to regain its footing in an industry that is ever-evolving, and where goodwill and trust are precious commodities. The looming challenges—a volatile stock market, regulatory scrutiny, and a distracted workforce—paint a precarious picture for the aerospace titan, necessitating urgent and thoughtful action to navigate these turbulent waters.

Leave a Reply