As the Federal Reserve approaches a critical meeting on December 18, the financial landscape stands poised for potential adjustments. Analysts widely expect that the Fed will implement another quarter-point interest rate cut, signaling the third consecutive reduction since the tightening months that began in late 2022. If this prediction holds true, it will enhance the cumulative rate cut to one full percentage point, a strategic move to address the persistent economic challenges arising from inflation, which recently reached a staggering 40-year peak. Senior economic analysts, like Jacob Channel from LendingTree, suggest this latest cut might mark the end of a rapid easing phase, as there remains a level of uncertainty regarding the fiscal policies that President-elect Donald Trump may introduce in his second term.

While immediate relief is anticipated for borrowers in many sectors, the Fed’s adjustments reflect a cautious approach to navigating from a previously aggressive rate hike strategy directed at curbing rampant inflation. Observers of the broader economic picture emphasize the necessity for the Fed to adopt a “wait-and-see” methodology moving forward, keenly aware of global uncertainties and their implications on domestic economic stability.

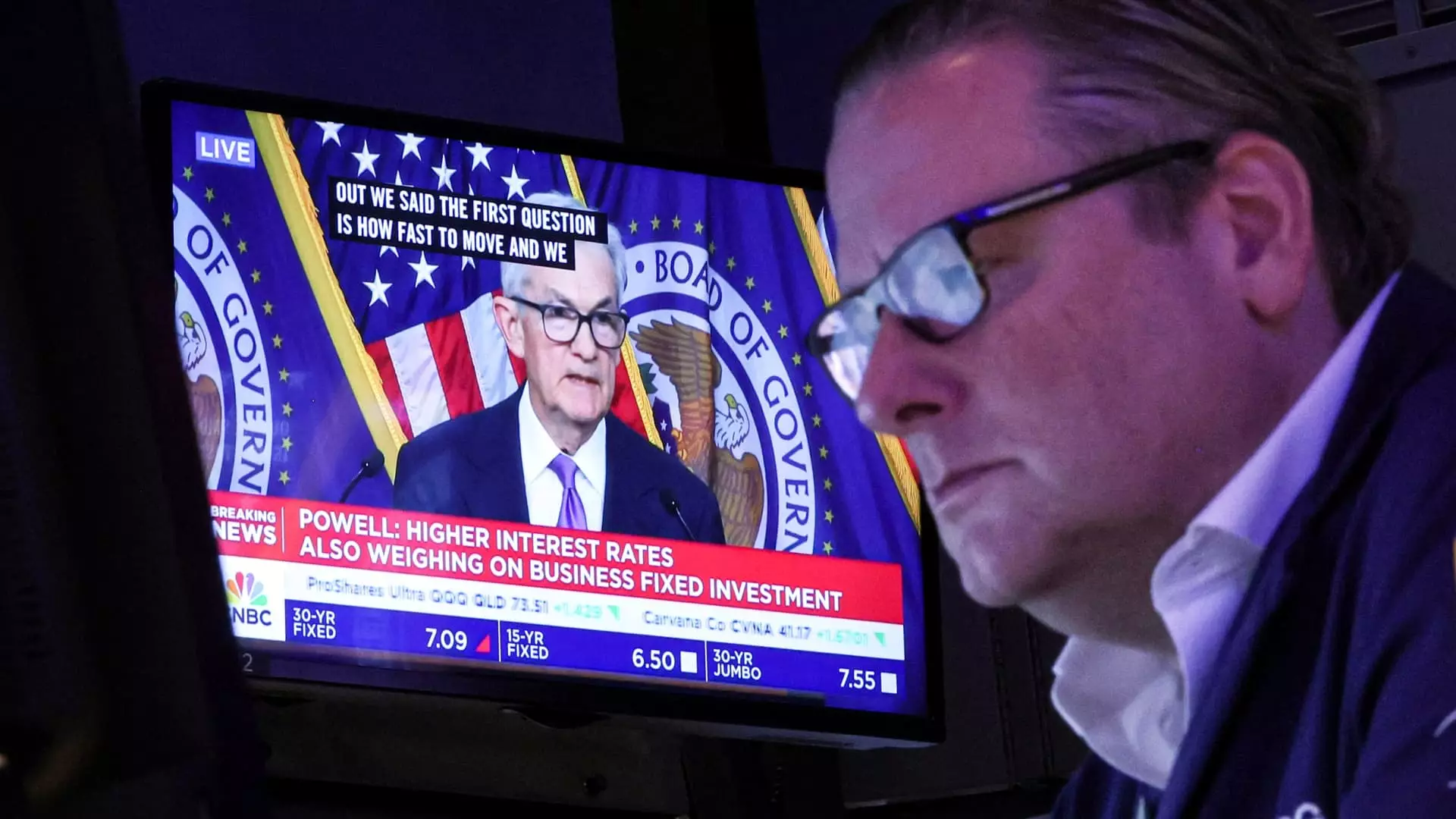

At the heart of these monetary policy shifts lies the federal funds rate, the benchmark that dictates the cost of overnight lending between banks. Though this rate isn’t the one consumers typically encounter directly, it underpins myriad aspects of personal financing, from mortgages and auto loans to credit card debts. A reduction to the federal funds rate is expected to adjust the baseline borrowing cost further to a range between 4.25% and 4.50%, compared to the current range of 4.50% to 4.75%.

Brett House, an economics professor at Columbia Business School, warns against assuming that these cuts will uniformly ease consumer financial pressures. Market responses may vary widely, and some critical interest rates that individual borrowers face do not have a direct correlation to changes in the Fed’s rate. The mechanics of interest rates in the consumer market require careful consideration, especially regarding how swiftly banks adjust their rates in response to Fed policy changes.

For those dealing with credit card debt, the anticipated cuts may soon provide marginal relief; however, the benefits may not be immediate. Credit cards operate largely on variable rates that adjust in tandem with the federal funds rate, but as Greg McBride, a chief financial analyst at Bankrate, points out, issuers often delay reducing rates in response to Fed cuts. Current statistics reveal a dramatic rise in average credit card interest rates—from 16.34% in early 2022 to an alarming 20.25%—making it imperative for borrowers to consider other strategies to manage their debt.

Shifting to a 0% balance transfer card emerges as a recommended approach for individuals burdened with credit card debt. This tactic allows consumers to prioritize the reduction of their principal balance without accruing further interest costs. Given the current climate, where interest rates may not decrease rapidly enough to alleviate soaring consumer debt, such proactive measures become invaluable.

Mortgage rates present another nuanced scenario in the context of Fed rate cuts. Most 15- and 30-year mortgages are fixed-rate products primarily influenced by broader economic factors rather than the Fed’s immediate policy changes. As of early December, the average rate for a 30-year fixed mortgage stood at 6.67%, significantly elevated from the lows seen earlier in the year. Homeowners with fixed-rate mortgages remain insulated from immediate fluctuations unless they opt for refinancing. However, industry insiders suggest a potential for ongoing variability, leaving consumers in a challenging position as they navigate home financing options.

On the auto finance front, rising sticker prices coupled with high average loan amounts represent growing challenges for potential car buyers. With the average rate on a five-year new car loan hovering around 7.59%, consumers find themselves increasingly squeezed, especially as the cost of vehicles continues to escalate. The Federal Reserve’s policy adjustments may not significantly alter payment structures for borrowers, making it critical for prospective car buyers to remain vigilant.

Student Loans and Savings Rates

Student loan borrowers encounter a bifurcated impact depending on whether their loans are federal or private. While federal student loan rates remain fixed, private loan holders with variable rates linked to Treasury yields may see benefits from a Fed rate cut. Refinancing options become more prevalent for those wishing to take advantage of lower rates, but borrowers must navigate the complexities and risks associated with moving from federal to private financing.

Interestingly, the recent Fed rate increases have created a unique environment for savers, with online savings accounts now yielding returns not seen in years—nearly 5%—according to analysts. As McBride highlights, this shift underscores a silver lining for a segment of consumers who prioritize savings amid the tumultuous borrowing environment.

The Federal Reserve’s anticipated decision to lower rates might signal a period of adjustments reflected across various consumer sectors. While many individuals can look forward to potential decreases in debt service costs, the complexities of how these changes interplay with existing financial products emphasize the importance of informed consumer behavior. As the Fed navigates uncertain economic waters, its decisions will ripple through the economy, influencing decisions made by borrowers and savers alike. Understanding the implications of these monetary policy changes remains essential as consumers engage with their personal finance strategies in an evolving economic landscape.

Leave a Reply