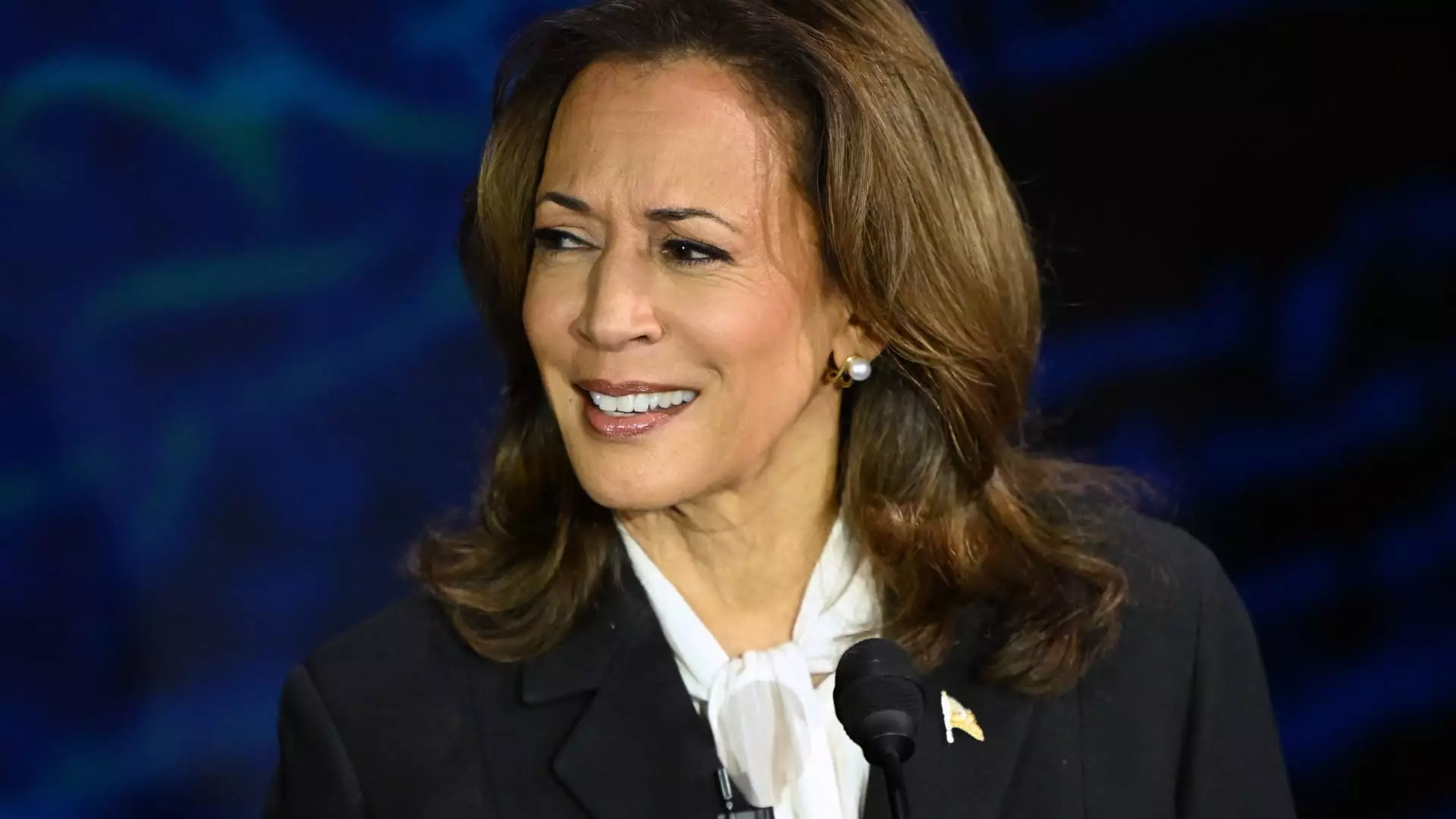

As the broader equity markets experienced a sell-off in response to the latest inflation data, one industry group stood out by demonstrating a surge in performance. Solar stocks took the lead, fueled by renewed optimism for renewable energy following the presidential debate. This surge was attributed to the potential victory of Vice President Kamala Harris in November. Despite a lackluster year-to-date performance, with the Invesco Solar ETF (TAN) down over 25%, solar stocks are showing resilience in the face of market volatility.

First Solar Inc. (FSLR) has shown an interesting technical configuration in 2024. After outperforming the S & P 500 earlier in the year and reaching a high above $300 in mid-June, the stock faced a sharp decline. It found support around $210 and entered a trading range between $200 and $240. This range aligns with previous resistance levels from 2023, highlighting their significance. In such consolidation phases, it is advisable to wait for a confirmed breakout beyond these levels. A move above the $240 resistance could lead to a retest of the 2024 high around $300.

Sunrun Inc. (RUN) presents a more attractive technical configuration compared to FSLR. The stock is already in a confirmed uptrend, marked by higher highs and higher lows. After finding support around $9 in late 2023 and retesting it in early 2024, RUN has shown strength. Pullbacks to the 50-day moving average often serve as entry points during uptrends. This week, the stock retraced to the ascending 50-day moving average, indicating a potential higher low. While RUN faces overhead resistance in the $20-24 range, a breakout above $24 could pave the way for further upside.

In times of market uncertainty, it is crucial to identify stocks and sectors that defy the overall trend. Solar stocks, despite their challenges, present compelling technical setups for investors. With the November elections approaching, the sector’s performance could be influenced by political developments. Investors are advised to monitor solar stocks closely in the coming months for potential opportunities. As markets navigate through volatility, understanding the technical dynamics of specific industries can provide valuable insights for decision-making.

The recent surge in solar stocks highlights the resilience and potential growth opportunities within the sector. By analyzing the technical charts of leading companies like FSLR and RUN, investors can gain valuable insights into potential trading opportunities. As the market landscape continues to evolve, staying informed and vigilant about industry trends and developments is essential for successful investing.

Leave a Reply