As we look ahead to 2024, the landscape of the municipal bond market is presenting a mixed bag of results driven by fluctuations in interest rates, investment patterns, and economic conditions. This article breaks down the recent trends, analyzing significant movements in yields, mutual fund inflows, and the overall health of the municipal bond market.

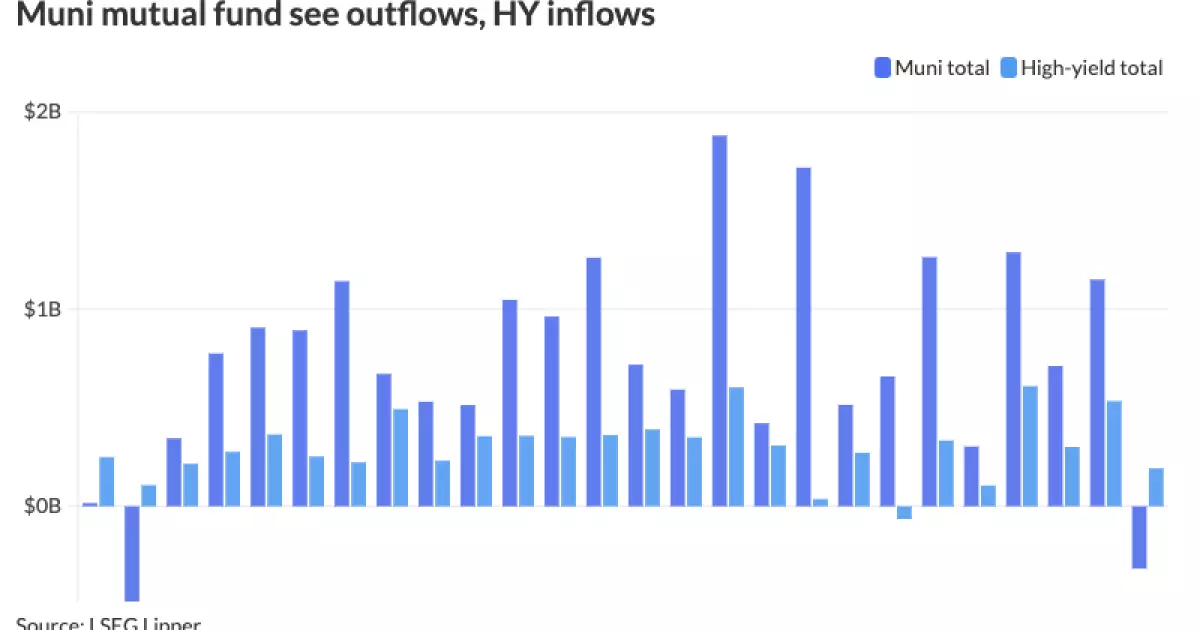

Over the past week, the municipal bond market has experienced noteworthy declines, particularly marked by the most significant cuts to triple-A yield curves this Thursday. The cuts, which ranged from two to ten basis points, were largely attributed to a slowdown in new issuance and, for the first time in over 20 weeks, outflows from muni mutual funds. According to recent data from LSEG Lipper, investors withdrew $316.2 million for the week ending December 11, marking the end of a streak of inflows that had accumulated to $1.15 billion just the previous week.

This reversal captured the attention of market observers, highlighting the sensitivity of municipal bonds to broader rate movements. Mark Paris, Invesco’s chief investment officer, articulated this sentiment, asserting that the municipal market is intricately linked to Treasury rate systems, especially in light of the Federal Reserve’s recent monetary policy decisions. “While some days may see munis outperform, prolonged periods of negative Treasury yields can naturally pressure muni yields,” he noted.

The Dynamics of Yield Ratios

On the same day of significant yield cuts, the ratios of municipal bonds to U.S. Treasury yields exhibited modest increases. For instance, completion of the analysis indicated that the two-year municipal-to-U.S. Treasury (UST) ratio settled at 62%, bolstered to 64% for the five-year, 66% for the ten-year, and reaching 81% for the thirty-year bonds. The slight uptick in ratios indicates that while munis are facing pressure, they are still maintaining a relative degree of attractiveness compared to Treasuries.

Paris raised an important query for investors to consider: if Treasury rates continue to decline, will long-end muni-UST ratios maintain their levels in the low 80s? This question underscores the ongoing complex interplay between municipal bond performance and those of U.S. Treasuries.

Market Activity and Cash Flow Trends

As we delve deeper into market activities, bids wanted surged to an impressive $2.41 billion, marking the highest level seen in over two years. This phenomenon can be largely attributed to liquidity needs due to recent deals and the fiscal positioning as the year closes. Kim Olsan, a portfolio manager at NewSquare Capital, pointed out that the prevailing tight yield range might soon see volatility, particularly if Treasuries continue under pressure.

Moreover, investors have shown a tendency to pull capital from tax-exempt municipal money market funds. This week alone saw an outflow of $1.25 billion, reducing total assets to $134.94 billion. The average seven-day simple yield in these funds had simultaneously dropped to 1.83%, whereas taxable money-fund assets surged by $6.94 billion, presenting an average yield of 4.28%.

While the news is less favorable for general municipal bond funds, the situation for high-yield municipal bond funds appears to be relatively positive, having attracted $192.3 million in inflows after a remarkable $533.6 million intake in the prior week. This juxtaposition reflects a possible shift in investor sentiment, where riskier assets are being favored amid a climate of uncertainty in the broader municipal market.

Investment-grade munis appear to have weathered the year reasonably well, with expectations of a record-high issuance in 2024. Paris suggested that the supply is likely to be absorbed effectively, signaling confidence in the market’s ability to cope with forthcoming issuance scenarios.

As we approach the end of the year, the municipal bond market is poised for a relatively quiet week in terms of new issuance, with the New York City Transitional Finance Authority expected to issue $1.5 billion in tax-exempt bonds. However, the overall issuance landscape for 2025 does look robust, with estimates hovering around $500 billion. Many experts anticipate that issuers could flood the market to preempt changes in tax exemption policies as Congress seeks out funds for upcoming financial obligations.

While the current stance of the municipal bond market showcases some challenges, particularly regarding inflows and market pressure, there are also signs of resilience and potential for future growth. Investors should remain vigilant in monitoring interest rate trends and the overall economic landscape as these elements will significantly impact the municipal bond market in both the short and long-term.

Leave a Reply